Federally Qualified Health Centers (FQHCs) play a vital role in delivering essential healthcare services to underserved populations, including low-income, rural, and vulnerable communities. However, navigating the complex billing and reimbursement landscape can be challenging. To ensure FQHCs remain financially sustainable and continue providing quality care, it’s crucial to understand the intricacies of Medicare, Medicaid, and other reimbursement systems.

The foundation of any healthcare organization’s financial stability is efficient revenue cycle management. It ensures that providers are compensated for the service they provide by covering every stage from patient registration to final payment. The practice of monitoring and controlling all financial activities related to patient care is known as revenue cycle management in the healthcare industry.

For example, when patients schedule an appointment, staff verify insurance and collect demographic data. After treatment, proper coding and clean claims are submitted. A robust RCM system healthcare makes sure these steps happen smoothly, minimizing errors and delays. That way, providers experience steady cash flow and can focus on patient care rather than chasing payments.

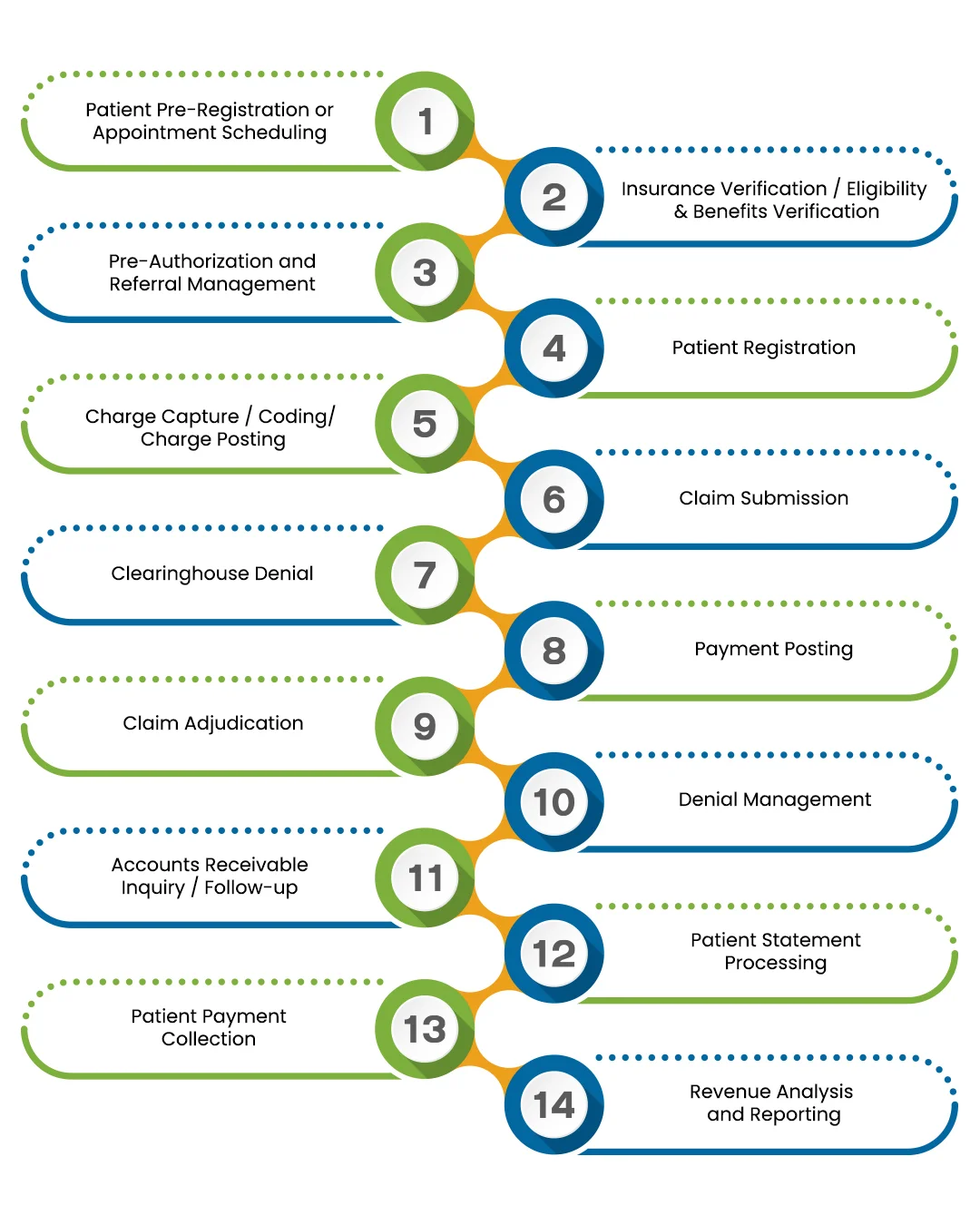

The following are the 14 steps of revenue cycle management in healthcare:

Prior to the visit (or throughout the scheduling process), gather basic patient demographic and insurance information. This initial stage aids in error detection, data accuracy, and billing workflow preparation.

Verify coverage, benefits, and patient responsibility before service. Accurate eligibility checks reduce denials and surprise bills, a core goal in effective revenue cycle management in healthcare.

Prior to providing care, handle pre-authorizations or recommendations for specific services (such as specialist visits and procedures). Payment delays or denials can be prevented by making sure the necessary approvals are in place.

Verify the patient’s identity, update or confirm insurance and demographic information, and obtain any required consents or documents at the time of service or check-in. This guarantees that the record is correct for processing claims and billing.

Assign the appropriate codes (such as diagnostic and procedure codes) and submit charges to the patient’s account for every service, procedure, treatment, or supply given during the visit. Correct billing and reimbursement depend on accurate charge capture and coding.

Prepare the claim (with all required codes and documentation) and transmit it to the payer (insurance or other responsible party), usually online. When claims are accurately and promptly submitted, processing and reimbursement proceed more smoothly.

Before reaching the payer, claims may be “scrubbed” or checked by a clearinghouse or claim‑editing system. This step helps catch formatting, coding, or compliance issues early — reducing the chance of outright rejection.

When the payer (or patient) pays, accurately post the payment to the patient’s account and reconcile it against billed charges. Correct payment posting keeps the revenue cycle management in healthcare ledger accurate.

The payer reviews and adjudicates the claim — determining whether it’s approved, denied, partially paid, or requires patient responsibility. This step determines what portion is covered and what remains as patient liability.

If a claim is denied (or underpaid), analyze the denial reason, correct errors (if applicable), and appeal or resubmit. Effective denial management helps recover revenue that might otherwise be lost.

Monitor and follow up on underpaid or unpaid claims and accounts on a regular basis. To ensure a sustainable cash flow, this entails monitoring outstanding accounts, pursuing past-due payments, and reducing aged A/R.

Create and email patient statements for all patient responsibility balances, including co-pays, deductibles, and uncovered charges. Patients are more likely to understand what is due when statements are precise and unambiguous.

Collect patient payments via online portals, in-person payments, phone payments, or payment plans. Flexible, patient-friendly collection methods strengthen revenue cycle management in healthcare by increasing point-of-service capture.

Measures like cash flow, clean-claim rates, days in accounts receivable, claim denial rates, and total reimbursement performance can be used to analyze financial performance. Utilise this information to pinpoint revenue cycle bottlenecks, inefficiencies, and potential improvement areas.

Healthcare organisations profit greatly from a strategic, well-managed revenue cycle. Effective RCM optimises revenue capture, improves patient happiness, and increases efficiency. Important advantages include:

Healthcare organizations can take concrete steps to improve their revenue cycle performance. Here are some effective strategies:

Even with great tools and staff, healthcare RCM faces many hurdles. Common challenges include:

Rising Claim Denials:

Denials are a top pain point. In fact, revenue cycle management statistics show that in a 2025 survey, 38% of healthcare RCM staff said at least 1 in 10 claims is denied, and 73% reported that denials are increasing. Denials may happen due to incorrect codes, missing documentation, or eligibility issues.

Solution:

Implement a rigorous denial prevention and appeal process. Track denial reasons closely and fix systemic errors. Automated claim scrubbing tools can catch many errors before submission.

Complex Billing Rules and Regulations:

Healthcare payers (Medicare, Medicaid, private insurers) all have different rules. Providers must keep up with changing regulations (e.g. ICD-10 code updates, prior authorization requirements). These hospital revenue cycle management challenges can overwhelm staff.

Solution:

Use decision-support tools that update coding and billing rules automatically. Train teams on regulatory changes and consider hiring compliance specialists.

High Administrative Burden:

Staff may get overworked due to the manual labour required to collect patient payments, check insurance, and reconcile finances. Simple mistakes happen when team members are overworked.

Solution:

Use tablet check-ins or applications, for example, where patients input their insurance information beforehand. To boost front-end collections, automate patient payment plans or installment alternatives.

Staffing and Workflow Issues:

It's challenging to find and keep qualified RCM employees. Knowledge gaps might result from high turnover. Delays may also result from inadequate communication between the billing, coding, and registration departments.

Solution:

Assign RCM liaisons or create cross-functional teams to monitor the lifespan of each claim. Give regular training and unambiguous SOPs. Consider revenue cycle solutions for hospitals that offer tech-enabled staffing support or partial outsourcing if internal staffing is limited.

Underpayments and Contract Management:

Occasionally, and frequently undetected, insurers underpay (pay less than the stipulated rate). Over time, lost reimbursements resulting from underpayments mount up.

Solution:

Compare contract rates with paid claims. To identify underpayments, use RCM analytics. Make use of programs or resources that can automatically find and retrieve underpayments from payers.

Given the hurdles, healthcare providers should follow time-tested best practices to keep the revenue cycle flowing smoothly. Key best practices include:

Technology and evolving care models are reshaping healthcare finances. Data and automation will soon dominate RCM. Leaders are already being forced to invest in more intelligent solutions due to growing expenses and labor shortages. For instance, according to an HFMA survey, 71.7% of hospital executives intended to give RCM technology investment top priority in the upcoming year.

Emerging technologies like robotic process automation and artificial intelligence (AI) are transforming revenue cycle management in the healthcare industry. AI algorithms can identify claims with a high risk of denial or flag expected underpayments before a claim is filed. AI-driven coding tools can provide real-time recommendations for the most accurate process codes. Intelligent automation can handle repetitive tasks, freeing up employees for special circumstances. Furthermore, cloud-based RCM solutions that seamlessly integrate with telemedicine and mobile apps are growing in popularity.

Value-based care and ambulatory expansion are two more trends for the future. RCM will have to adjust to new payment structures as more care is moved to preventive and outpatient programs. Because outpatient and inpatient billing regulations differ, hospitals are already developing customised workflows for outpatient RCM. Hospital revenue cycle systems will generally become more adaptable, enabling hybrid care models.

Healthcare revenue cycle management is increasingly being outsourced worldwide. Many large health systems are working with expert revenue cycle management companies that use cutting-edge automation, often based overseas. This tactic lowers costs and speeds up improvements. For example, several companies now outsource all of their back-office billing, allowing them to expand quickly without hiring new staff.

By outsourcing your billing services to us, you can expect revenue growth of up to 20%

Please provide the following information, so our team can connect with you within 12 hours.

Or call us as 800-640-6409