When it comes to medical billing, provider identification plays a major role in ensuring accurate claims submission and proper reimbursement. Two of the most important identifiers used in healthcare are the NPI (National Provider Identifier) and the Tax ID (TIN or EIN – Employer Identification Number). While they are often mentioned in the same sentence, they serve entirely different purposes.

If you are setting up a new practice, billing for claims, or working in healthcare administration, understanding how these two numbers work—and how they are used together—can save you from costly delays or claim rejections.

Let’s break it down.

Confused About NPI vs Tax ID?

We’re here to help you sort NPI & Tax ID differences. Book a consultation with our experts today.

Contact Us NowWhat is an NPI Number?

An NPI (National Provider Identifier) is a unique 10-digit identification number issued to healthcare providers by the Centers for Medicare & Medicaid Services (CMS). It is mandatory for all HIPAA-covered entities, including:

- Physicians

- Dentists

- Nurses

- Clinics

- Hospitals

- Laboratories

- Pharmacies

Why is it Needed?

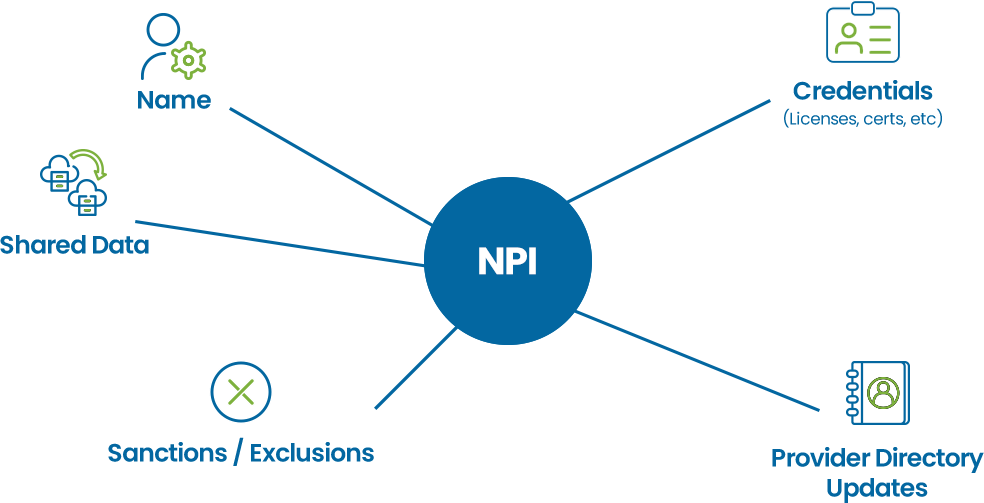

The NPI helps identify who performed the healthcare service. It’s used in claims, referrals, eligibility checks, and other HIPAA-standard electronic transactions.

What Are Type 1 and Type 2 NPIs?

National Provider Identifiers (NPIs) are special ID numbers used in the U.S. healthcare system. They help insurance companies and other providers know who gave the care and where it happened. NPIs are needed for billing and are used in all HIPAA-related tasks.

There are two types of NPIs:

- Type 1 NPI is for individual healthcare providers like doctors, dentists, nurses, and therapists. Each person can only have one Type 1 NPI, even if they work in different places.

- Type 2 NPI is for healthcare organizations such as hospitals, clinics, and group practices. These groups can have more than one Type 2 NPI if they have different offices or business setups.

Both NPI types are important. For example, when a patient goes to a large clinic, the Type 2 NPI shows which clinic they visited, while the Type 1 NPI shows which provider actually saw the patient.

Example:

Let’s say Dr. Emma Torres is a family physician working at City Wellness Clinic.

- Dr. Torres’ Type 1 NPI: 1234567890

- City Wellness Clinic’s Type 2 NPI: 1122334455

In a claim, the individual provider’s NPI (Dr. Torres) might appear in the rendering provider field, and the clinic’s NPI in the billing provider field.

Comparison Table: Type 1 vs. Type 2 NPI

| Feature | Type 1 NPI (Individual) | Type 2 NPI (Organization) |

| Definition | Assigned to individual healthcare providers | Assigned to healthcare organizations or group entities |

| Who Qualifies | Physicians, dentists, nurses, physical therapists, pharmacists, BCBAs, RBTs, etc. | Hospitals, physician groups, clinics, nursing homes, home health agencies, etc. |

| Number Per Entity | One NPI per individual regardless of locations | One or more NPIs depending on the structure or practice locations |

| Purpose | Identifies the specific provider who delivers care | Identifies the organization or facility where care is delivered |

| Required For | Individual billing, credentialing, claims, and prescriptions | Facility-level billing and organizational claims processing |

| HIPAA Compliance | Mandatory for individual providers under HIPAA | Mandatory for organizations handling HIPAA transactions |

| Billing Example | Used to specify who treated the patient in a group or hospital | Used to specify where the patient was treated or which organization provided care |

| Issued By | Centers for Medicare & Medicaid Services (CMS) | Centers for Medicare & Medicaid Services (CMS) |

| Format | 10-digit numeric code (same for both types) | 10-digit numeric code (same for both types) |

Steps and Requirements to Obtain an NPI

Healthcare professionals and organizations must apply for a National Provider Identifier (NPI) to participate in insurance credentialing and billing. This 10-digit number is used to uniquely identify providers in healthcare transactions. NPI numbers are divided into two categories: Type 1 is assigned to individual healthcare providers, while Type 2 is designated for organizations and group practices.

For Individual Providers:

Applicants must provide personal details, including full name, date of birth, and Social Security Number. Information about their practice—such as location, specialty, and any licenses or certifications—is also required during the application process.

For Group Practices:

An authorized representative must complete the application on behalf of the organization. This person is responsible for submitting the group’s legal name, business address, Tax Identification Number (TIN), and their own contact information.

Having an NPI is essential for interacting with insurance payors. It’s a requirement for credentialing and is necessary for submitting claims. Without it, providers and healthcare groups cannot receive payments from insurance companies. NPIs allow insurers to accurately identify providers, verify claims, and ensure timely reimbursements.

How Does a Group NPI Differ from an Individual NPI?

Healthcare providers who deliver direct patient care must obtain an Individual NPI, which is a unique identifier that stays with them throughout their professional career, regardless of where they work. Agencies, on the other hand, are assigned a Group NPI based on their Tax ID.

To ensure proper credentialing and accurate billing, each provider’s Individual NPI must be associated with the Group NPI. This step is essential to link the provider correctly under the agency’s contracts with payors.

Even if a provider holds an Individual NPI and has a separate agreement with an insurance company, they cannot be billed under the group unless they are officially connected to the group’s contract. Establishing this link is a key part of the credentialing process.

How Does This Relate to Rendering Providers?

When submitting claims, the billing and rendering NPIs are entered in separate sections of the CMS-1500 form. The rendering provider’s NPI, which is their Type 1 Individual NPI, should be entered in Box 24J. Box 33A should include the billing provider’s NPI, which is typically the Type 2 Group NPI.

However, placing the correct NPIs in the right boxes is not enough. The provider’s individual NPI must also be officially connected to the group’s NPI with each insurance payor. Without this connection, claims may not be processed correctly, and payments could be delayed.

Even if a provider is credentialed with an insurance company, that alone is not sufficient. The provider’s individual NPI must be linked to the group’s billing NPI for the group to receive payment for services.

The rendering NPI identifies the provider who delivered care to the patient. The billing NPI identifies the individual or organization responsible for receiving payment for the services provided. In solo practices, one provider may use the same NPI for both rendering and billing.

Some providers may have more than one billing NPI. For example, a provider might operate a private practice with its own NPI and also work for another clinic or group with a different billing NPI. As long as each NPI is properly set up and recognized by the insurance companies, this is acceptable.

If you are responsible for billing and are unsure whether all NPIs are properly established and linked, it is best to contact the insurance carriers for confirmation. Taking the time to verify can help avoid claim issues later.

What is a Tax ID (TIN or EIN)?

A Tax Identification Number (TIN), also called an Employer Identification Number (EIN), is a 9-digit number issued by the Internal Revenue Service (IRS). This number serves as a business identifier for tax-related activities.

Who Uses a Tax ID?

- Group practices

- Healthcare organizations

- Independent clinics

- Solo providers who have incorporated their practice

It tells the IRS who is responsible for reporting income and paying taxes. In medical billing, it tells the insurance payer where to direct the payment.

Example:

City Wellness Clinic might have a Tax ID like: 12-3456789.

This number is used for billing and tax filings.

So, while Dr. Torres’ NPI identifies who rendered the service, the Tax ID identifies who gets paid.

Types of Tax Identification Numbers

- Social Security Number (SSN): A Social Security Number is a nine-digit identifier issued to U.S. citizens, permanent residents, and eligible working residents. While originally created to track earnings and benefits with the Social Security Administration, the SSN is now commonly used in many areas, including taxation, credit reporting, and personal identification. Individuals must use their SSN when reporting income or filing personal tax returns with the IRS.

- Employer Identification Number (EIN): Also known as a Federal Tax ID, this number is issued by the IRS to recognize and track business entities. It is required for activities such as filing business taxes, opening business bank accounts, applying for licenses, and hiring employees. This number allows a clear distinction between a company’s finances and the personal finances of its owners, which is essential for maintaining accurate business records and fulfilling tax obligations.

NPI vs. Tax ID: Why Both Are Needed in Medical Billing

Both numbers are required to submit a clean claim:

- The NPI tells the insurance company who performed the service.

- The Tax ID tells them who receives the reimbursement.

Billing Example:

A patient visits the City Wellness Clinic and is treated by Dr. Emma Torres.

- Claim lists Rendering Provider NPI as Dr. Torres (1234567890)

- Claim lists Billing Provider NPI as City Wellness Clinic (1122334455)

- Claim lists Tax ID as 12-3456789 (Clinic’s EIN)

This ensures that:

- Dr. Torres is credited for the visit.

- The clinic receives payment.

- The IRS records the payment under the correct tax entity.

Can a Solo Provider Have Both?

Yes. A solo provider who owns their own practice might use their Type 1 NPI for both rendering and billing but still have a separate Tax ID if the practice is set up as an LLC or corporation.

If the solo practitioner is not incorporated and bills under their Social Security Number (SSN), then that becomes the default TIN.

What Happens If You Mix Them Up?

Using the wrong NPI or mismatching it with a Tax ID can lead to:

- Delayed payments

- Denied claims

- Payer audits

- Compliance issues

Example Error:

If you submit a claim with Dr. Torres’ NPI but the Tax ID of a different clinic, the payer won’t be able to match the provider with the billing entity. The claim will be denied or returned for correction.

Comparison Table: NPI vs. Tax ID

| Feature | NPI (National Provider Identifier) | Tax ID (TIN or EIN) |

| Issued By | CMS (Centers for Medicare & Medicaid Services) | IRS (Internal Revenue Service) |

| Purpose | Identifies the healthcare provider | Identifies the billing entity |

| Used For | Claims, referrals, HIPAA transactions | Tax filings, payments, legal ID |

| Format | 10-digit number (e.g., 1234567890) | 9-digit number (e.g., 12-3456789) |

| Required For | All HIPAA-covered providers | All entities that receive payment |

| Type | Type 1 (Individual), Type 2 (Organization) | EIN, TIN, or SSN |

| Tells the Payer | Who provided the service | Who should be paid |

| Changes With Ownership? | No (NPI stays with the provider) | May change if tax entity changes |

| Public Information? | Yes (available in NPPES registry) | No (protected for privacy) |

| Use in Healthcare | Billing, claim processing, EHRs | Billing, tax reporting, credentialing |

Improve Claims Accuracy Now

Our experts help align NPIs and tax IDs correctly so your claims get processed quickly and payments increase.

The Bottom Line

Understanding the roles of the NPI and Tax ID in medical billing and coding services is crucial for submitting clean claims, receiving proper reimbursement, and staying IRS compliant. Think of the NPI as your professional identifier and the Tax ID as your financial address—both are essential, but they serve very different purposes.

When used correctly, they help keep your billing process efficient and reduce the risk of denials or delays. Whether you’re a solo practitioner or part of a multi-specialty clinic, make sure your claims consistently include the right pairing of NPI and Tax ID.