Revenue Cycle Management is a process that is employed in the US healthcare system. In the United States, the revenue from patients is tracked from their first encounter with a medical facility to avail any form of medical service or product to their most recent payment of balance.

The cycle can be defined as, “all administrative functions that are involved in the capture, management, and collection of patient service revenue.” It is crucial for a medical healthcare practice if they want to ensure financial growth.

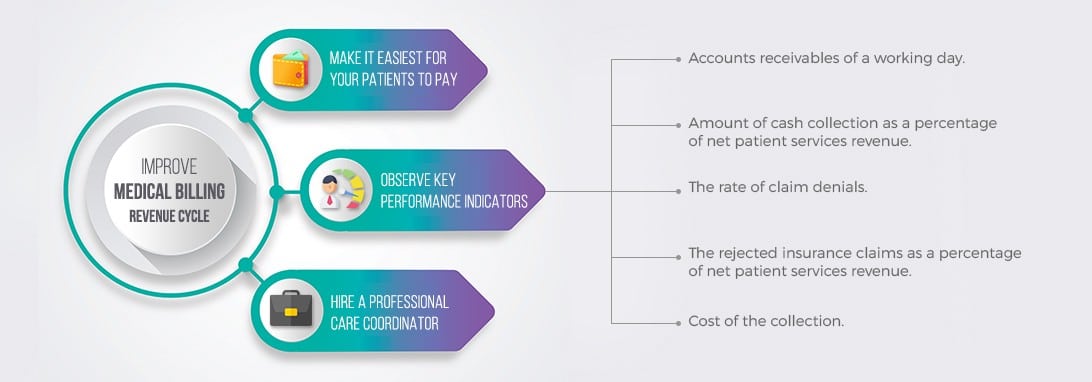

For any practice to thrive, revenue needs to exceed expenses. The concept is simple, and yet it is often overlooked. Improvement in Revenue Cycle management means that you are consistently improving your financial health. There is a lot of opportunities to improve your revenue cycle management process. Here, are some of the most natural tips that will help you do that.

Make it Easiest for your Patients to Pay

You need to make your expectations as a medical practitioner crystal clear to the people who are your patients. Make sure they understand how much and when they have to pay you. Make payments from them as convenient as possible by accepting payments on an online portal and phone. Navicure survey claims that 70% of the patients show comfort in this means of payment, but only 20% of healthcare providers offer these forms of payment., This is a huge opportunity to quickly improve your revenue cycle

Observe Key Performance Indicators

Pay close attention to key accounting metrics. This information will provide insight into the financial health of your medical practice. Being able to organize and properly audit accounting records is a critical skill for medical professionals.

Here are some KPIs to keep an eye on:

– Accounts receivables of a working day.

– Amount of cash collection as a percentage of net patient services revenue.

– The rate of claim denials.

– The rejected insurance claims as a percentage of net patient services revenue.

– Cost of the collection.

Monitoring KPIs will give you sense whether you practice going in the right direction or not. If you see that you are not hitting your KPI goals, consider bringing in a billing specialist to help you.

Hire a Professional Care Coordinator

A Care coordinator in a medical facility is someone who helps transition a medical practice to a value-based model while ensuring it complies with legislation and policy changes. The care coordinator is a proxy between a healthcare provider and a patient, encouraging the patient to be compliant and responsible while keeping the medical facility organized. An experienced medical care coordinator can play a vital role in improving healthcare quality and management. As a medical healthcare provider, proper revenue cycle management is critical to maintaining and growing the financial side of your medical practice.