A recent AMA survey found that over 85% of providers report delays in payer credentialing as one of the top barriers to timely reimbursement. For a new provider, that can add up to thousands of dollars before the first reimbursement arrives. Many practices underestimate how serious these delays can be until cash flow slows down.

Credentialing is the process that gives you the license to bill. It proves to payers that you are qualified, compliant, and safe to reimburse. Enrollment goes hand in hand; it is the official step where payers add you to their network so you can start receiving payments. Without both, even the cleanest claim will not get paid.

In this blog, we will walk through the main systems you need to know: PECOS, CAQH credentialing, and payer enrollment portals. We will also look at the common roadblocks that cause credentialing delays and share proven fast-track tips to help you stay on schedule. By the end, you will know how to avoid pitfalls and move faster from paperwork to payment.

Credentialing is the point where patient care meets your bottom line. Without it, your practice cannot turn visits into revenue. Every day spent waiting for approval is a day of unpaid work.

What happens when you are not fully credentialed and enrolled?

The impact goes beyond money. Long delays cause patient frustration, poor first impressions, and gaps in care. For a new provider, these delays can break cash flow.

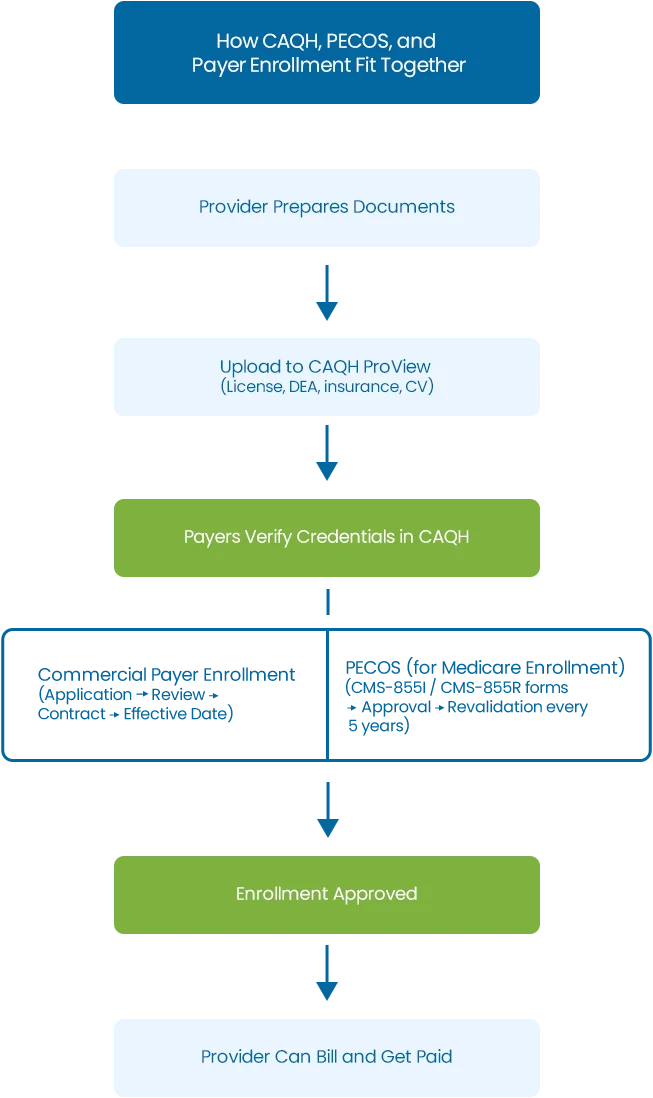

Thus, one needs to know how CAQH, PECOS, and payer enrollment work together.

CAQH ProView is the main digital hub for provider credentialing. Almost every commercial payer in the U.S. uses it to verify your professional details. Think of it as your online application folder that payers check before approving you for enrollment.

In CAQH credentialing, you must upload and keep current key documents, such as:

If these are expired or missing, payers will not process your application.

Payers depend on CAQH credentialing because it centralizes information. Instead of sending the same documents to each insurer, you update them once in CAQH and grant access to multiple payers. This speeds up the review process. It also reduces duplicate work.

These errors create credentialing delays. They may cause payers to deny or hold your application.

Pro Tip:

Set calendar reminders to re-attest in CAQH every 120 days. Even if nothing changes, this refresh is required for payers to keep your profile active.

PECOS stands for Provider Enrollment, Chain, and Ownership System. It is the official online system for Medicare enrollment. Any provider that wants to bill Medicare must enroll here. PECOS collects your details, verifies your eligibility, and connects you to the Medicare program so you can begin receiving reimbursements.

In PECOS enrollment, you complete forms like:

These forms ensure Medicare knows exactly who is billing and under what tax ID or group.

Revalidation every five years is another critical step. Medicare requires all providers to update and confirm their information on a set schedule. If you miss this, your billing privileges can be suspended until your file is corrected.

Pro Tip:

Always use online PECOS instead of paper. It can cut processing time by and reduce the risk of clerical errors.

Once CAQH credentialing and PECOS enrollment are in place, the next step is enrolling with commercial insurers and Medicaid. Each payer has its own process, but the steps usually look like this:

The effective date is critical. Even if you start seeing patients earlier, you will not get paid until that date. Unlike Medicare, most commercial payers do not backdate contracts.

Case Example: One provider began treating patients before receiving approval from BCBS. When the effective date came through, all earlier claims, worth nearly $25,000, were denied. The services were valid, but the timing made them ineligible.

This is why tracking applications, following up with payers, and waiting for the official effective date before billing is essential.

| System | Purpose | Who Uses It | Key Documents / Forms | Common Issues | Pro Tip |

|---|---|---|---|---|---|

| CAQH ProView | Central database for provider credentials | Commercial payers | License, DEA, malpractice, board certs, work history | Missed attestations, expired documents, and mismatched data | Re-attest every 120 days |

| PECOS | Medicare enrollment gateway | Medicare, CMS | CMS-855I (individual), CMS-855R (reassignment) | Using paper forms, data mismatches, missed 5-year revalidation | Always use online PECOS to cut months off processing |

| Payer Enrollment | Getting in-network with commercial and Medicaid plans | Individual providers & groups | Payer-specific applications, contracts | Long timelines (60–120 days), no backdating, CAQH errors | Track effective dates before billing |

Credentialing is rarely smooth, and the same issues show up across CAQH, PECOS, and payer enrollment. Providers who don’t prepare for these bottlenecks often end up stuck in long delays.

| Common Credentialing & Enrollment Problems |

|---|

| 1. Data mismatches A small difference, like an address in CAQH not matching PECOS, can stall an application for weeks. Every system must reflect the same details, including NPI, tax ID, and practice location. |

| 2. Slow timelines Even when everything is correct, payers take 60–120 days or more to process. Add missing documents or committee backlogs, and the delay can double. |

| 3. Missed deadlines PECOS revalidation, CAQH attestations, or payer requests for additional documents all come with time limits. Missing them often forces you to restart the process. |

| 4. Lack of follow-up Applications frequently sit untouched until someone calls or checks on them. Payers rarely notify you unless you actively follow up. |

| 5. Revenue risk Seeing patients before approvals come through is the biggest financial hit. Claims are denied, and most insurers will not backdate contracts. |

| 6. Medicare vs. commercial overlap If you change your practice location or tax ID, both PECOS and each commercial payer must be updated. Forgetting one creates mismatched records and denied claims. |

| 7. Hospital privileges Some payers require proof of hospital admitting privileges (for certain specialties) before granting approval. Missing this step often delays enrollment. |

| 8. Group vs. individual enrollment mix-ups A new provider joining a group must be linked under the group’s tax ID. Filing only as an individual will block claims from being paid under the group. |

| 9. Retroactive billing limits Medicare sometimes allows limited backdating if applications are filed properly. Most commercial payers do not, meaning services before the effective date go unpaid. |

| 10. CAQH access oversight Even with a complete CAQH profile, payers cannot see it unless you grant them access. Providers often overlook this and wonder why their enrollment is stuck. |

| 11. Re-credentialing cycles Every payer requires re-credentialing every 2–3 years. Missing this is like failing initial credentialing—it can suspend your contract. |

| 12. Delegated credentialing gaps Large groups sometimes negotiate delegated credentialing to speed up approvals. Smaller practices often don’t realize this option exists or how much faster it can be. |

Credentialing doesn’t have to take months. With these steps, you can speed it up and avoid mistakes:

Use CAQH as your main system. Make sure the information in CAQH, PECOS, NPPES, and payer apps matches exactly. Small errors cause delays.

Use online systems like PECOS and CAQH instead of paper. Electronic submissions are faster and reduce mistakes.

CAQH needs re-attestation every 120 days, and Medicare needs revalidation every five years. Missing deadlines can freeze your file. Set reminders to stay on track.

Do not assume payers are working on your application. Call or email every two weeks until you see progress. A polite nudge often moves files forward.

Begin credentialing at least 90–120 days before you plan to see patients. This buffer protects your revenue from denied claims.

Never submit claims before the payer confirms your effective date. This avoids wasted work and unpaid balances.

If your specialty requires admitting privileges, make sure these are updated and documented. Missing them stops payer approval.

Credentialing is not a barrier or hurdle; it’s a pathway to smooth revenue. A structured process can help you save time and prevent errors.

Here’s a basic checklist to optimize your workflow:

When you follow these steps in routine, you will notice a visible difference in your revenue cycle. Credentialing will actually help you to boost cash flow instead of blocking it.

By outsourcing your billing services to us, you can expect revenue growth of up to 20%

Please provide the following information, so our team can connect with you within 12 hours.

Or call us as 800-640-6409