Across the United States, most insurers must pay or deny a clean dental claim in roughly 30 days, especially when it is submitted electronically. Yet many dental practices still wait closer to 30–45 days to collect, and even a modest 5–10% first-submission denial rate slows cash flow that should already be yours.

That gap often comes from mistakes that can be easily fixed by following the correct steps of dental RCM. If you are a new practitioner or planning to do in-house billing, this article will guide you through the steps of dental revenue cycle management.

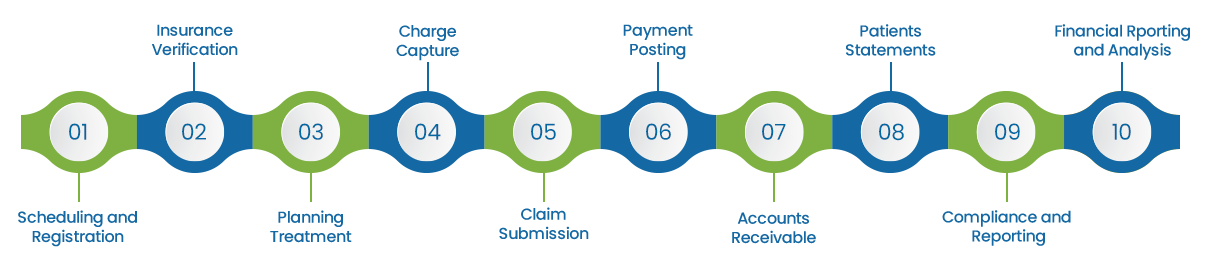

Below is the detailed explanation of how each of these steps works and how you can practice them daily in your clinical practice.

First things first: book the appointment. It sounds simple, but this is where a smooth money-and-billing process (dental RCM) begins. When the schedule is set up well, the office can confirm visits, handle cancellations, and move people around without losing time or money.

Next comes registration. New patients share their basic details, health history, and insurance information on a form or in an electronic system. Getting this right at the start helps later, because mistakes here can slow down the processing of bills or cause an insurance claim to be sent back.

Before any dental treatment, the office ensures that the patient’s insurance will cover the cost. They look up what the plan covers, what the limits are, and whether the patient has a co-pay or a deductible. Knowing this early prevents surprises about what the insurance will and won’t pay.

Sometimes, the insurance company wants a “yes” in advance. That’s called pre-authorization. If a procedure needs it, the office asks for approval. This way, everyone knows about the treatment’s approval, and the bill won’t be a surprise.

After check-in, the dentist creates a treatment plan based on what the patient needs. They explain what will happen and how much it will cost. Clear communication at this point is crucial because it helps the patient understand what they’re responsible for paying.

When the visit is completed, the team documents the dental services provided to patient using special number codes (such as CDT or ICD-10). These codes tell the insurance exactly what was done. Use the right code, and the claim can be paid correctly. Using the wrong code will result in a denied claim, or it might be paid less than what you expected.

After a visit, the office records exactly what was done, perhaps a cleaning, perhaps a root canal. Every service counts. Getting these details right helps the practice get paid what it’s owed.

The team enters the performed procedure into the billing system using the correct procedure codes, notes, and patient information. Those details become the claim that the practice will send to the insurance company.

The next step is to submit the claim. Most offices do this electronically because it’s faster than paper and easier to track.

Sending a claim isn’t the end of revenue cycle management dental. You have to watch it. Claims can be delayed or even denied.

Good systems from reputable dental revenue cycle management companies like MedCare MSO display claim status in real-time. It allows the team to identify problems and contact the insurance company promptly to resolve them.

If a claim gets denied, don’t give up. Read the reason, correct any mistakes, add the missing documents, and send an appeal. Many denials can be overturned with the right information.

When insurance pays, the office records that payment in the patient’s account. Now everyone can see what was covered and what wasn’t.

Sometimes, there’s still money due, such as a co-pay, deductible, or a service the plan didn’t cover. The practice then bills the patient for the remaining balance and offers clear payment options.

Money that hasn’t come in yet is called “accounts receivable.” Watching it closely keeps the practice’s cash flow healthy.

Aging reports show how long each balance has been waiting—30 days, 60 days, or longer. These reports help the team decide who to follow up with first.

If a balance is late, start with simple measures: friendly reminders and calls. If it drags on for an extended period, the account may be sent to a collection agency. Acting early usually prevents that and brings in the payment sooner.

When a patient still owes money, send a clear statement. Keep it simple: what the visit cost, what insurance paid, and what’s left to pay. No complications.

Most offices mail or email statements about once a month. Offer choices such as an online portal, card, check, and a payment plan. The easier it is, the faster bills get paid.

Dental offices must adhere to laws that protect patient information and ensure accurate billing. HIPAA requires you to safeguard private health information and handle it in a proper manner. Insurance companies also have their own rules, and those need attention, too.

Consistent reports indicate the revenue flow, identify bottlenecks, and highlight areas for potential enhancement. With steady reporting, the team can identify trends early and address problems before they escalate.

Revenue isn’t “set it and forget it.” The process needs to be checked again and again. Look for slow steps, repeated mistakes, and claims that keep getting denied. Train front-desk and billing staff so everyone understands the flow from scheduling to payment. Clearly defined roles help to reduce errors.

Effective RCM solutions and software, like EHRs and practice management systems, can make tasks easier. They help find coding errors and reduce manual data entry.

Dental revenue cycle management (RCM) isn’t just paperwork. On-time payments fund better tools, fair pay, and more patient care. Clear estimates and simple bills reduce surprises and build trust. People pay confidently when they know what they owe and how to pay.

RCM ensures complete notes and clean claims, reducing rework so staff spend more time with patients. It lowers stress, supports compliance, and provides visibility to what’s working so you can adjust and plan for growth.

Dental Revenue Cycle Management (RCM) consists of a series of interconnected steps rather than an enigma. Begin with efficient scheduling and registration. Verify benefits to ensure that estimates are accurate. Provide treatment and documentation with diligence. Record charges on the same day they occur. Submit clean claims with the appropriate attachments through reliable dental billing services. Post payments meticulously, line by line. Bill patients transparently and maintain consistent follow-up practices. Utilize collections only when absolutely necessary. Review your reports regularly and implement minor improvements each month.

By executing these steps effectively, the subsequent tasks will become more manageable. The transition of responsibilities among team members will be seamless. Cash flow will be timely, patients will feel well-informed, and your team will experience a sense of pride rather than urgency.

Consider printing these steps and sharing them during a brief team meeting. Select one small improvement to initiate today. Continue this practice daily, and your practice will remain robust for years to come.

By outsourcing your billing services to us, you can expect revenue growth of up to 20%

Please provide the following information, so our team can connect with you within 12 hours.

Or call us as 800-640-6409