Medical claim forms are essential in healthcare billing. They are formal requests that healthcare providers send to insurance companies, Medicare, Medicaid, or other entities to get reimbursed for services provided to patients.

These forms are legal documents that prove the payment request based on specific insurance rules. They ensure patients’ healthcare costs are covered, providing financial security. Insurance companies use these forms to verify services and process claims accurately. Healthcare providers rely on these forms to receive prompt payment for their services.

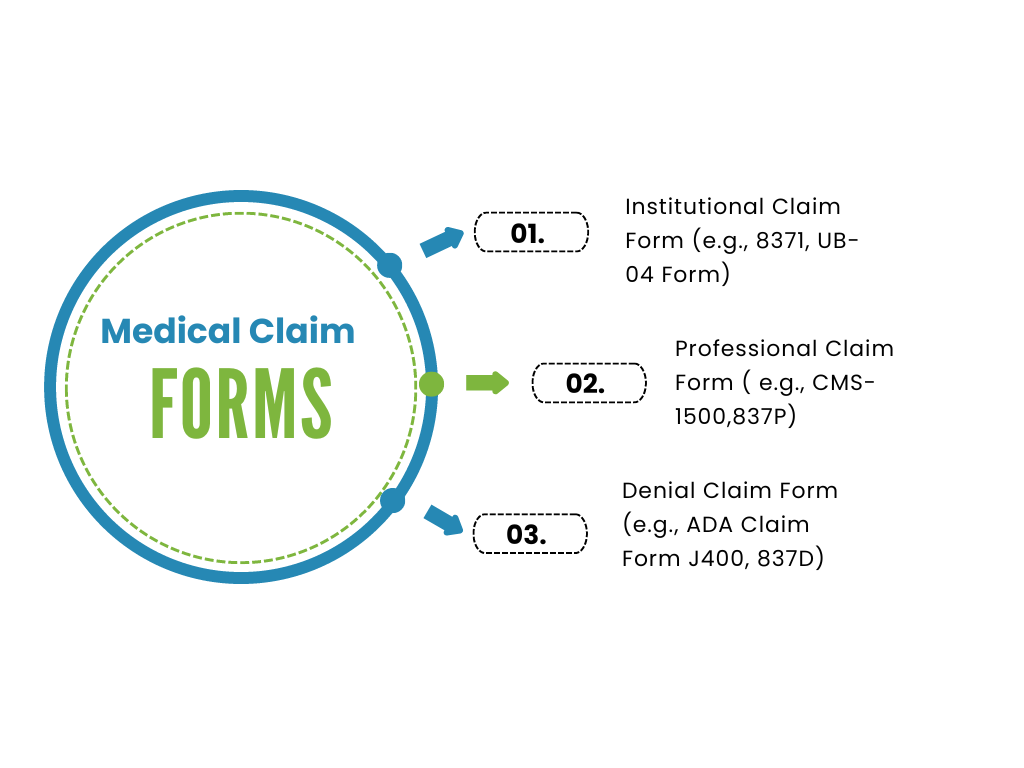

Three Main Types of Medical Claim Forms Used in the US Healthcare System

In the US healthcare system, medical claim forms are crucial for requesting reimbursement for healthcare services. These forms gather important details such as patient information, services provided, diagnosis, and charges.

Here are the main types of medical claim forms used:

- Institutional Claim Form (e.g., 837I, UB-04 Form)

- Professional Claim Form (e.g., CMS-1500, 837P)

- Professional Claim Form (e.g., CMS-1500, 837P)

Let us discuss them in detail for your better understanding.

Institutional Claim Form

Institutional claims are filed by hospitals, clinics, and healthcare facilities to seek payment from insurers for patient services. These forms detail the patient’s medical history, services provided, and costs incurred.

Types of Institutional Claim Forms

There are two main types of institutional claim forms: electronic and paper.

The electronic form, 837 Institutional (837I), is commonly used today for faster processing without additional paperwork. The older paper form, UB-04 or CMS-1450, is used when electronic submission isn’t possible, often for complex cases requiring extra documentation.

837I is efficient for routine claims, while UB-04 suits special cases. Overall, electronic 837 Institutional claims are now standard for institutional providers.

Professional Claim Form

Independent doctors, therapists, and licensed healthcare providers use professional claim forms to bill insurance companies for services rendered. These providers include physicians, physical therapists, psychologists, and others who directly treat patients. They fill out these forms with details such as treatment dates, services performed, and total charges to request payment from insurers.

Maximize Billing Revenue Now

Let our team handle claims accurately, reducing denials and increasing payments.

Types of Professional Claim Forms

There are two main types of professional medical claim forms: electronic and paper.

The electronic form, 837 Professional (837P), adheres to the ANSI ASC X12N standard for healthcare transactions, similar to the institutional 837I form. It enables efficient electronic submission of claim data, making it suitable for practices handling numerous claims.

The traditional paper form is the CMS-1500, used by doctors and clinics to mail claims. It includes all the necessary fields and codes required for reimbursement.

The 837P is favored for its speed, accuracy, and integration with billing systems, while the CMS-1500 is preferred by providers who prefer paper submissions or have lower claim volumes. Both forms serve the essential function of ensuring providers receive payment for their services.

Dental Claim Form

When a patient visits a dentist in the United States, the dentist submits a claim to the patient’s insurance provider using a Dental Claim Form. Unlike a general medical claim form, this form is specifically designed to detail dental procedures and care. Submitting these claims is a core part of dental billing services, which ensure accurate and timely reimbursement from insurance providers.

The goal of a Dental Claim Form is straightforward: it allows dentists to bill insurance companies so patients don’t have to pay the entire cost upfront, and dentists can get paid for their services.

Key details on the Dental Claim Form include the patient’s name and insurance information, service date, descriptions of procedures performed, charges for each service, and the total amount due. The dentist sends this form to the patient’s insurance provider, who processes the claim and pays their portion. Patients may need to pay any remaining balance according to their insurance plan.

Without Dental Claim Forms, dentists would struggle to receive payment, and patients would face higher out-of-pocket costs.

Types of Dental Claim Forms

There are two main types of forms used for dental insurance claims:

- ADA Dental Claim Form J400: This standardized paper form (created by the American Dental Association) is used when a dentist needs to bill an insurance provider for dental treatment.

- 837D: This electronic form follows HIPAA standards and is used similarly to the J400 but in a digital format. Dentists enter patient and treatment information into their practice software, which generates the 837D for electronic submission to insurance providers.

To summarize, the ADA Dental Claim Form J400 is paper-based and widely accepted, while the 837D is electronic and increasingly preferred for its efficiency and compliance with HIPAA. Both forms ensure that insurers receive accurate information about the dental care provided. This helps dentists receive proper reimbursement for their services.

Anatomy of Medical Claim Forms

Each form includes these key sections:

- Patient Information: Includes demographics such as name, date of birth, and insurance ID.

- Provider Information: Details about the physician or facility providing the service.

- Procedure Information: Includes diagnosis codes and details about the service provided.

- Charges: Lists the cost of the service(s).

- Insurance Information: This includes your insurance details and policy number.

The Key Attributes of a Medical Claim Form

| Field | Description |

|---|---|

| Code | The unique code for this claim form |

| Description | The description for this claim form |

| Insurance Type | The insurance type for this claim form |

| Claim Form Type | Optional reference to claim form type |

| Procedure 1 usage name | The attribute name in dynamic logic |

| Procedure 1 definition | Flex Code System that defines which codes can be entered |

| Procedure 1 fatal non match indicator | If checked, a non match leads to a fatal system message. If not, an informative message is applied instead |

| Procedure 2 usage name | The attribute name in dynamic logic |

| Procedure 2 definition | Flex Code System that defines which codes can be entered |

| Procedure 2 fatal non match indicator | If checked, a non match leads to a fatal system message. If not, an informative message is applied instead |

| Procedure 3 usage name | The attribute name in dynamic logic |

| Procedure 3 definition | Flex Code System that defines which codes can be entered |

| Procedure 3 fatal non match indicator | If checked, a non match leads to a fatal system message. If not, an informative message is applied instead. |

When processing medical claims, there’s a step where the system automatically matches procedure codes. If the codes don’t match, a non-match indicator is triggered. This indicator ensures that fake codes can’t be entered on the claims page or submitted through integration points.

- Each claim form corresponds to a specific type of insurance, such as health, car, or travel insurance, determining its purpose within the business.

- Every claim form is categorized under a single claim form type, used in various rules to group similar claim forms.

- For instance, in the US health insurance sector, claim forms represent different submission methods, including electronic formats like 837P, 837I, and 837D, and paper forms like UB04, CMS1500, and J400.

- The UB04 and 837I are both institutional claim forms, treated identically for adjudication, whether submitted electronically or by mail. This means they fall under the “Institutional” claim form type.

Top 10 Strategies to Fill Out Medical Claim Forms

Here are 10 tips for filling out medical claim forms effectively:

- Ensure accurate patient and insurance information, including name, date of birth, insurance ID, and group number. Verify the insurance payer’s mailing address to prevent payment delays.

- Use the correct claim form—CMS 1500 or UB04—based on your provider type. Use the latest form version to avoid rejections.

- Record accurate diagnosis (ICD-11) and procedure (CPT) codes that match the services provided to prevent processing delays.

- Include supporting documentation like operative reports and progress notes to substantiate the medical necessity of billed services. Lack of documentation often leads to claim denials.

- Charge fees within allowed amounts or negotiate predetermined rates with insurers to avoid payment delays and patient dissatisfaction.

- Obtain pre-authorization for hospital admissions, procedures, and services as required by insurance plans to avoid claim denials.

- Adhere to timely filing deadlines, typically 30-90 days from the service date, specified by the insurer. Late submissions can result in denied claims.

- Submit claims electronically through a clearinghouse whenever possible to minimize errors and expedite processing. Use paper forms only when electronic filing isn’t feasible.

- Follow up on unpaid claims within 30 days. Check for denials or requests for additional information, and resubmit or appeal as necessary to maximize reimbursement.

- Maintain thorough records of all claims, correspondence, and remittance advice for easy reference. Organized records help track claim status, identify trends, and resolve issues promptly.

Not sure how to choose and fill out the right claim form? We’re here to assist you!

For healthcare providers, handling claim forms like CMS 1500 or UB-04 is crucial. Making even a small error can delay or deny your reimbursement and lead to penalties.

Stop struggling with claim forms—MedCare MSO can help! Our medical billing specialists excel at handling paperwork that many providers find daunting. We ensure your claims are complete, accurate, and ready for quick reimbursement, easing your practice’s workload.

Trust us with your complex claim forms while you focus on patient care. Contact us today to ensure the smooth processing of your claims.