Did you know U.S. healthcare providers are projected to lose $16.3 billion in 2025 due to issues like delayed claims, especially medical billing errors, and compliance gaps? These revenue leaks don’t just affect balance sheets. They also impact staffing, patient services, and the overall financial health of organizations.

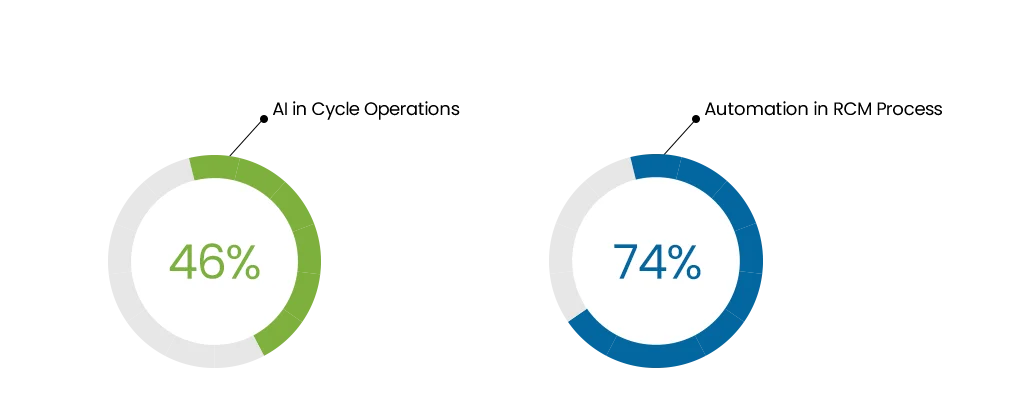

The problem is that most of the revenue cycle is still handled manually. Teams spend hours fixing data, chasing denials, and resubmitting claims. Adopting AI helps reduce claim denials and automate RCM, freeing staff from manual rework. It’s slow and stressful. And costs keep rising while payer rules get more complicated.

AI can spot mistakes before they happen, move tasks faster, and take repetitive work off staff plates.

In this blog, we’ll look at where AI actually fits into the revenue cycle, how it’s being used today, and what results providers are already seeing. But first, let’s start with the basics on how AI works in RCM and how it is better than manual workflows.

Understanding AI in Revenue Cycle Management

AI in Healthcare RCM is all about making the process smoother. It helps providers reduce errors, expedite approvals, and increase revenue faster.

Traditional automation tools follow strict rules. If something doesn’t fit the rule, the system fails. AI works differently. It learns from messy data, past claims, and payer patterns. That means it can spot when something looks “off” and adjust before it turns into a denial.

AI can also chain tasks together. For example, it might check coverage, prepare an authorization, and track it, only pausing when a human needs to step in.

How AI Fits in the Revenue Cycle Management?

AI is transforming every stage of revenue cycle management services. Its influence spans front‑end, mid‑cycle, and back‑end operations. It reduces errors, increases efficiency, and improves patient and provider experiences.

Front-End

AI helps with eligibility and benefits through eligibility verification automation. It checks patient coverage automatically, reducing ineligible services and claim denials. Prior authorization is essential yet frequently delayed; AI accelerates it by analyzing patient data against guidelines to expedite approvals. It also aids in registration by fixing duplicate records and streamlining appointment scheduling.

Back-End

Denials are predicted and prevented using ML models. AI systems pre‑scrub claims, lower denial risk, and draft appeals within an automated appeals workflow. Using extraction tools, it processes ERA and EOB data automatically. Then, personal outreach tools manage patient billing. As a result, administrative teams spend more time on decisions, not paperwork.

Key AI Technologies Used in Revenue Cycle Management

Healthcare organizations use a suite of AI technologies to enhance RCM. These include automation, machine learning, document processing, and intelligent agents.

- One key component of AI in RCM is Robotic Process Automation (RPA). RPA uses software bots to copy data, enter information into portals, or click through workflows. It handles repetitive tasks and keeps them fast and consistent.

- Machine Learning (ML) adds prediction. It looks at past data to spot likely denials, underpayments, or patients who may not pay. This helps staff focus on targeting problems even before they arise.

- Natural Language Processing (NLP) reads notes, charts, and documents. It pulls out key details like diagnoses and procedures to support coding and documentation.

- Optical Character Recognition (OCR) and Intelligent Document Processing (IDP) turn messy files into usable data. They work on PDFs, faxes, and images. These tools pull patient and claim details from EOBs, referral letters, and other documents.

- Generative AI (GenAI) helps write foundational text. It generates appeal letters, prior authorization narratives, and patient communications. Human reviewers check and approve the content before it’s submitted.

Modern RCM uses a combination of these AI technologies to reduce manual effort and increase accuracy. The technologies work together, creating smarter, faster, and more adaptable revenue workflows.

Boost surgical revenue with our EMR & billing experts for every specialty.

AI vs. Manual Revenue Cycle Management

This table shows a clear breakdown of differences between manual and AI RCM workflows.

| Workflow Stage | Manual RCM Workflow | AI-Powered RCM Workflow |

|---|---|---|

| Patient Registration & Eligibility | Front-desk staff manually collect demographics and insurance cards, then enter the data into the system. Eligibility checks are done by calling payers or logging into payer portals. | AI extracts patient data from documents/EHR and auto-verifies eligibility with payers in real time. |

| Medical Coding | Coders manually review clinical notes and assign CPT/ICD codes. The risk of missed or outdated codes is high. | Natural Language Processing (NLP) reads provider notes, suggests accurate CPT/ICD codes, and flags compliance gaps instantly. |

| Claim Creation & Scrubbing | Billers prepare claims and manually check for missing modifiers or mismatched information. | Machine learning models compare claims against payer rules and past denials to catch errors before submission. |

| Claim Submission | Claims are submitted electronically or on paper; errors often surface only after payer review. | Clean claims are auto-submitted to the right payer, with routing optimized by AI. |

| Payment Posting | Payments from insurers are manually matched and posted to patient accounts. | Electronic remittance advice (ERA) is read and posted automatically, reconciling accounts with minimal human input. |

| Denial Follow-Up | Staff track denials, research payer rules, and file appeals manually, often weeks later. | AI predicts which claims may get denied and fixes them upfront; for actual denials, bots initiate follow-ups automatically. |

| Reporting | Reports are generated monthly or quarterly, usually retrospective, with limited insights. | Dashboards show cash flow, denial trends, and payer performance live, not weeks later. |

The results aren’t just theory. MedCare MSO saw a significant impact while using their AI-powered PMS, Maximus:

- 92% Providers saw 18.3% Growth

- 30% Reduction in A/R

- 1.2% Lowest Denial Rate

- 20% Reduced Cost to Collect

- 24% Hour Complaint Resolution Support

Manual RCM is slow, costly, and error-prone. AI turns it into a faster, more accurate, and more proactive process, one that helps providers collect revenue with less effort and fewer delays.

Frustrated with slow workflows and costly denials?

Regulatory and Industry Changes Driving AI Adoption

New rules are shaping how healthcare uses AI in revenue cycle management. Here are the key updates:

- CMS Interoperability & Prior Authorization (CMS-0057-F):

Payers must implement FHIR‑based Patient and Provider Access APIs that include prior authorization data (excluding drugs), with full compliance by January 1, 2027; some operational requirements begin in 2026. - Medicare Pilot (WISeR Model):

Starting January 2026, CMS will run the WISeR model in Arizona, New Jersey, Ohio, Oklahoma, Texas, and Washington, using AI tools plus clinician oversight to expedite prior authorization decisions on select procedures. - Federal Oversight:

A 2023 Executive Order directed HHS to create an AI assurance policy for healthcare, setting expectations for safe and responsible AI deployment.

| Regulation | Description | Effective Timeline |

|---|---|---|

| CMS-0057-F Final Rule | Requires FHIR APIs for PA, patient/provider access, and payer data sharing | 2026 (start); full compliance by 2027 |

| WISeR Medicare Pilot | AI-assisted prior auth in traditional Medicare; clinician retains approval | Starts Jan 2026 |

| State AI Coverage Laws | AI-only denials prohibited without clinician oversight (CA, others proposed) | Already in effect or under active debate |

| Federal AI Oversight EO | AI assurance framework for healthcare tools (UM, QA, etc.) | Ongoing development |

Benefits of AI in Revenue Cycle Management

AI is transforming healthcare revenue cycles by enhancing accuracy, accelerating workflows, and improving financial outcomes.

1. Faster Processing and Improved Cash Flow

AI accelerates claim processing. Some organizations report up to 30% faster claim processing times, reducing delays in payment reception. By streamlining eligibility checks and claim submission, AI helps secure revenue more quickly. Waystar, in collaboration with Google Cloud, reduced the time to generate a procedural preauthorization report by 99.93%, while improving accuracy by 13%.

2. Reduced Manual Workload and Increased Staff Productivity

AI takes over repetitive, low-value work. Providers using it have cut manual workload by about 40%, giving staff more time for higher-priority tasks. Generative AI also saves time—around 17 minutes per claim check and 16 minutes per eligibility check in high-volume processes. The result is a clear boost in productivity.

3. Fewer Errors and Denials

AI identifies potential coding and documentation errors before claims are submitted; fewer mistakes mean fewer denials. Experian Health, for instance, used AI to reduce claim denials by 4.6% per month at Schneck Medical Center. Providers also cite improved workflows and accuracy in areas like charge capture and claim auditing.

4. Proactive Denial Management and Prior Authorizations

AI helps identify potential denials ahead of time. Dashboards now give real-time insights into payer behavior and denial patterns.

5. Better Patient Payment Predictions and Engagement

AI looks at billing history and payer data to predict which patients are likely to pay. This helps staff focus outreach and create personalized payment plans.

Challenges & Risks of AI in Revenue Cycle Management

AI has big potential in RCM, but it also comes with risks, making clear planning, strong oversight, and well-designed digital foundations such as healthcare app development essential for smooth workflows.

Data Quality, Integration, and Infrastructure Risks

AI needs clean, reliable data to work well. Old systems with missing or siloed data make training and integration difficult.

Automation Bias and Human Oversight

When time-pressed staff follow AI outputs without question, mistakes can multiply. One pathology study revealed a 7% rate of automation bias, where experts accepted incorrect AI suggestions, harming decision accuracy.

Bias, Transparency, and Ethical Concerns

AI systems trained on non-representative data risk reinforcing inequalities and systemic bias. Models may be “black boxes,” lacking transparency or explainability. This threatens trust and reproducibility in healthcare.

Cybersecurity and Accountability

Granting AI wide access raises the risk of cyber breaches and unintended actions. Expanding key system permissions to AI agents can expand the attack surface.

Additionally, the line of accountability becomes blurry when autonomous systems act without clear human control. Clear oversight and logging are essential. When coupled with GenAI and security protocols, these are essential to ensuring resilience and avoiding attacks

Regulatory and Ethical Gaps

Currently, AI systems in healthcare—especially payment and denial automation—operate in a largely under-regulated landscape. Guidelines like TRIPOD‑AI and CONSORT‑AI exist, but enforcement and oversight lag behind deployment.

Workforce Impact and Resistance

AI may disrupt roles traditionally handled by RCM staff. Workforce resistance is a risk if change isn’t managed well. Many healthcare CFOs report low organizational readiness for AI despite recognizing its importance.

Need EMR & Billing Expert for Surgical Practices?

Conclusion

AI in revenue cycle management is no longer a futuristic idea; it’s becoming a necessity. Rising costs and new rules are forcing providers to move past outdated billing processes. Those who act early gain faster payments, stronger compliance, and more stable revenue especially when coupled with specialized physician billing services.

This shift isn’t about replacing people. It’s about giving teams the right tools. When AI handles the repetitive work, staff can focus on patients and decisions that matter. The result is a smoother revenue cycle and a healthier future for healthcare organizations.