In healthcare, the financial stability of an organization largely depends on how well revenue cycle management (RCM) is handled. As the industry continues to evolve, it’s essential for organizations to grasp the complexities of RCM. With the growing complexity of healthcare delivery, optimizing RCM is key to ensuring timely reimbursement and plays a crucial role in improving patient care, boosting efficiency, and maintaining financial health.

This guide takes a closer look at the essential components of RCM, current trends, challenges, and the role of technology in improving processes. It also examines how healthcare organizations can address the specific challenges within RCM to enhance cash flow and streamline operations.

What is Revenue Cycle Management?

At its core, revenue cycle management is the financial process healthcare organizations use to track patient care episodes from registration and appointment scheduling to the final payment of the balance. It includes a series of administrative and clinical functions that contribute to the capture, management, and collection of service revenue. RCM not only ensures a smooth workflow but also influences the profitability and financial viability of healthcare providers, regardless of practice size or specialty.

RCM includes various stages such as patient registration, charge capture, insurance verification, coding, claim submission, and payment posting. Each of these steps requires efficiency and accuracy to minimize errors, prevent delayed payments, and optimize reimbursement.

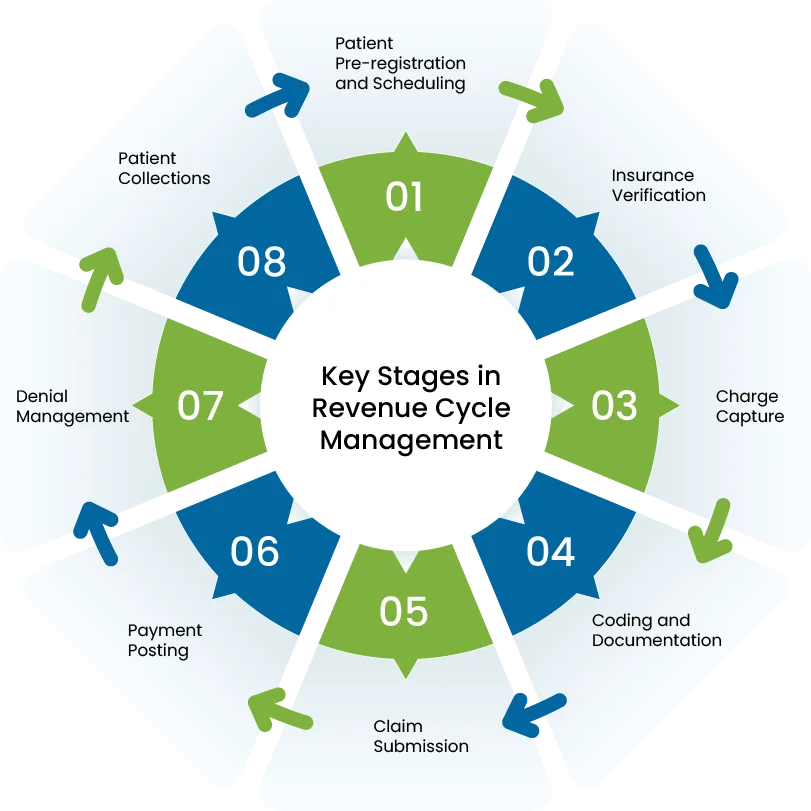

Key Stages in Revenue Cycle Management

The RCM process is multifaceted, and each stage plays a pivotal role in ensuring proper reimbursement for the services rendered. Here’s a detailed breakdown of the essential stages of RCM:

- Patient Pre-registration and Scheduling

The RCM process begins before the patient even steps foot into the healthcare facility. During the pre-registration phase, healthcare providers collect essential information from the patient, including insurance details and personal demographics. Ensuring accurate data capture at this point is critical as it can affect the billing accuracy later in the process.

For instance, a hospital might face difficulties in billing if insurance details are incorrectly entered or if there are discrepancies in the patient’s demographic information. These early-stage errors can lead to unnecessary delays, denials, and disruptions in the revenue cycle.

- Insurance Verification

Insurance verification is one of the most critical components of the RCM process. Healthcare providers must verify insurance eligibility and coverage before providing services. Failure to do so could result in claim rejections, which are costly and time-consuming.

Many healthcare practices and facilities still rely on outdated manual methods for insurance verification, which increases the risk of errors. Advanced technologies like Electronic Data Interchange (EDI) and integrated software systems can help streamline the process, ensuring that insurance eligibility is checked in real-time and that claims are submitted with accurate payer information.

- Charge Capture

Charge capture is the process of recording the services provided to a patient and translating them into billable charges. Accurate charge capture is critical for ensuring that the provider is reimbursed for all the services rendered. This process typically involves recording procedures, medications, tests, and other services that the patient received.

One of the most significant challenges in charge capture is undercharging or missed charges, which occur when certain services are not documented properly. This can result in revenue loss for the healthcare provider. Using automated charge capture tools can reduce the risk of missed charges and enhance the overall accuracy of billing.

- Coding and Documentation

The next step in RCM is the application of coding to document diagnoses and procedures performed during the patient’s visit. This is an essential step for ensuring that providers are paid accurately and in compliance with government regulations, including the Affordable Care Act (ACA), and to avoid penalties.

For example, incorrectly coding a procedure or diagnosis can lead to improper reimbursement or worse, a compliance audit. The complexity of coding regulations makes it essential for healthcare providers to have certified medical coders and an updated coding system. The adoption of automated coding solutions can help reduce errors and streamline this process.

- Claim Submission

Once the coding is complete, healthcare providers submit claims to insurance companies for reimbursement. The submission process must be accurate, complete, and comply with payer requirements to avoid denials or delays.

A claim submission is a delicate balance between providing enough detail and adhering to payer rules. For instance, insurance companies often require specific documentation, such as procedure notes or patient medical histories, which must be submitted along with the claim in a specific timeline.

Healthcare providers can increase the likelihood of claims being processed and paid on time by integrating their RCM systems with payer networks, ensuring that claims are transmitted electronically and are in the correct format.

- Payment Posting

Once insurance companies process the claims, they issue payments, which must be recorded by healthcare organizations. Payment posting refers to the practice of matching payments received with the claims submitted.

In many cases, providers may face challenges when payments don’t align with expectations, leading to discrepancies and the need for follow-up. Payment posting errors can result from miscommunication between payers and providers, such as incorrect payment amounts or delays in processing. Utilizing advanced software systems can help minimize these discrepancies and ensure payments are processed smoothly.

- Denial Management

Denial management is a key area of focus for healthcare organizations. When claims are denied, providers must investigate the reasons for the denial, correct the issues, and resubmit the claim for payment. A denied claim can result in a significant delay in payment and has a direct impact on cash flow.

A well-designed denial management strategy includes tracking denial reasons, identifying trends, and addressing the root causes of denials. By analyzing denials, healthcare providers can develop strategies to reduce future denials, such as improving coding accuracy, streamlining the claims process, or ensuring compliance with payer-specific rules.

- Patient Collections

Patient collections are an increasingly important aspect of the RCM process. As patients are responsible for a larger portion of healthcare costs through high-deductible plans and co-pays, healthcare providers must ensure timely collections.

This process involves reaching out to patients for any outstanding balances. Successful patient collections rely on clear communication, empathy, and the flexibility to offer payment plans.

Additionally, utilizing technology, such as patient portals and automated reminders, can improve the collection process by making it more convenient for patients to pay their bills.

What Is the Overall Goal of RCM?

The goal of revenue cycle management is to ensure accurate revenue throughout the process by identifying deficiencies and improving them. Efficient RCM also helps organizations address compliance issues like fraud, waste, and abuse. For example, consider a situation where unnecessary tests or procedures are being ordered for patients. This could happen due to a lack of oversight or due to billing practices that encourage overutilization of services. These unnecessary tests can lead to inflated healthcare costs, overbilling, and potential legal violations.

Benefits of An Effective Revenue Cycle Management

Below, we have mentioned the top 7 benefits of having an optimized revenue cycle:

- Streamlining Communication and Data Management: RCM connects patient accounts and clinical care by aligning important data, like insurance details and treatment records. This connection improves efficiency and reduces errors, ensuring smoother billing and collection cycles.

- Improving Billing and Collection Processes: A strong RCM system streamlines appointment scheduling, patient pre registration, payment collection, and claims processing. It reduces administrative work, leading to faster reimbursements and fewer errors.

- Reducing Denied Claims: RCM systems gather all necessary data for claims processing, helping prevent the need for claims to be revised or resubmitted. This reduces the number of denied claims, saving both time and money.

- Enhancing the Patient Experience: RCM helps improve the patient experience by ensuring transparency in billing. For example, verifying insurance eligibility upfront allows patients to know about any balances or financial expectations early on.

- Better Financial Management and Reporting: Accurate billing and coding help reduce denials. RCM systems allow patients to pay bills online and enable healthcare providers to manage and store billing records securely. This improves financial management and reporting.

- Supporting Compliance and Documentation: RCM ensures that proper documentation supports charges based on medical necessity. This improves patient safety by allowing clinicians to review clear, accurate records, leading to better care.

- Analyzing Performance and Outcomes: RCM systems provide data for analyzing the performance of the revenue cycle through the KPI dashboard. Healthcare providers can monitor processes, identify issues, and make adjustments to improve efficiency. This helps keep the revenue cycle optimized over time.

Common Challenges Healthcare Providers Face in RCM

Healthcare RCM faces numerous complexities in areas like coding, billing, compliance, credentialing, data analytics, and integrating paper charts with EHRs.

- Coding and Billing Accuracy

Precise coding and billing are critical for smooth cash flow. Medical coding involves extracting billable information, while billing converts those codes into claims. Errors in these areas can lead to denied claims, requiring time-consuming corrections and resubmissions, leading to lost revenue.

- Compliance Standards

Healthcare RCM must meet multiple compliance requirements to prevent fraud, waste, and abuse. This includes safeguarding patient data under HIPAA regulations, maintaining accuracy in coding, conducting audits, and ensuring proper electronic claim submissions. Non-compliance can result in hefty fines and penalties, potentially exceeding $1 million.

- Credentialing Providers

Provider credentialing is necessary for reimbursement. This process involves confirming provider qualifications, such as board certifications and submitting documentation to payers. If credentialing is not properly completed, reimbursements may be delayed or denied, impacting the financial health of the practice.

- Data Analytics

Data analytics helps identify trends in billing errors, missed opportunities, and revenue performance. By analyzing reports on claim denials, charges, and reimbursements, healthcare organizations can address inefficiencies, improve billing accuracy, and enhance overall revenue cycle performance.

- Incorporating Paper Charts

The use of paper charts complicates the RCM process because they are not integrated with EHRs, which can lead to incomplete patient information for coders and auditors. This can hinder accurate billing and care coordination, impacting both the quality of patient care and financial performance.

- Patient Financial Responsibility

As patients are taking on more of their healthcare costs, managing collections becomes more challenging. Providers need to offer flexible payment plans and find ways to navigate high patient balances while still securing timely payments.

- Complexity of Payer Rules

Healthcare organizations must deal with a wide range of payer rules, each with specific requirements that can vary. This makes it difficult to maintain accuracy and consistency in billing and claim submissions.

- Staffing and Training

It’s a constant struggle to find qualified medical coders and billers who are up-to-date with the latest regulations. Continuous training is needed to keep staff knowledgeable about evolving coding standards, payer requirements, and billing guidelines.

How to Improve Revenue Cycle Processes in a Clinic or Physician Practice

Improving revenue cycle processes requires a careful examination of each stage of the cycle. By identifying areas of strength and those that need improvement, practices can streamline operations and enhance overall efficiency. Data analytics can provide specific insights, guiding decision-making and pinpointing where changes are most needed. Below are key areas to focus on for improving revenue cycle management.

The Importance of a Qualified RCM Manager

Successful RCM depends on the understanding that all steps of the cycle are interconnected. A problem in one stage can cause a ripple effect, impacting other processes. Therefore, having a qualified RCM manager or director is crucial. This professional should be proficient in medical billing, able to communicate effectively with clinicians and other staff and maintain a well-organized operation. They play an essential role in unifying front- and back-end operations, ensuring smooth workflow across all stages.

Front-end processes typically involve patient interaction, such as registration, eligibility verification, and pre-authorization, while back-end processes cover administrative functions like claims management, denials, and collections. The coordination between these functions is essential for the efficiency of the revenue cycle.

Tired of RCM bottlenecks and revenue loss?

Optimizing Front-End Processes

Efficient front-end processes lay the foundation for a smooth back-end workflow. Here are some critical areas that directly impact RCM:

- Accurate Patient Information: Billing starts with proper scheduling and registration. If patient information such as name, address, insurance details, or injury-related information is incorrect, it can trigger denials from insurers. Accurate demographic information is crucial to avoid unnecessary complications.

- Eligibility Verification: Verifying patient eligibility before each visit ensures that the patient’s coverage aligns with the payer and plan details provided. This step reduces the risk of denials and ensures services are covered.

- Prior Authorization Management: Managing prior authorizations is key to revenue cycle efficiency. Certain healthcare services or medications require approval from the insurer before they are provided. Without this approval, practices may lose revenue. Ensuring proper prior authorization management helps prevent delays and revenue loss.

- Provider Involvement in Peer-to-Peer Reviews: In some cases, involving providers in peer-to-peer reviews with insurance companies can help secure reimbursement. These reviews clarify why a particular service is needed, which can lead to the approval of a prior authorization. Effective communication between the clinical and business teams is essential to ensure this process runs smoothly.

- Clinical and Billing Coordination: Clear communication between clinical and billing teams is crucial to avoid discrepancies. Proper documentation and alignment between clinical records and patient accounts ensure that all information is accurate and consistent.

Additional Steps to Improve Your Revenue Cycle Management

In addition to optimizing front-end processes, there are several other actions clinics and practices can take to enhance RCM performance:

- Stay Current with Guidelines and Codes: Keeping up to date with medical code changes is critical. Using outdated or incorrect codes can result in claim rejections and delays in payment. Regularly updating coding practices ensures smoother claims processing.

- Implement Charge and Coding Edits: Introducing edits for charges and coding helps catch errors early. This includes checking for missing modifiers or coding inconsistencies, such as National Correct Coding Initiative (NCCI) edits. These edits assist with proper claim submission and timely reimbursement.

- Assign a Compliance Liaison: A designated compliance liaison who regularly audits charges ensures that billing remains accurate and compliant with regulations. This person helps prevent billing errors and ensures all necessary codes and charges are included.

- Handle Denials Strategically: Denial management should be approached promptly and systematically. Assessing similar denials and addressing them collectively can lead to faster revenue recovery. Tackling denials in a timely and organized manner improves cash flow and reduces the chances of lost revenue.

- Utilize Technology for Efficiency: Utilizing technology can significantly streamline the RCM process. From automating billing and coding checks to tracking claims in real-time, technological tools can help reduce administrative burdens and improve overall efficiency.

Why Should Healthcare Facilities Use RCM Software Solutions?

Revenue cycle management software plays a crucial role in streamlining operations for medical practices and healthcare facilities. It simplifies tasks ranging from appointment scheduling to ensuring accurate medical billing and coding, which are essential for smooth insurance claim processing and timely payment collection. By automating patient chart management, RCM software enhances accuracy, reduces manual work, and frees up staff to focus on patient care.

The Role of Technology in RCM Efficiency

Technology has revolutionized RCM, making processes faster, more efficient, and less prone to errors. When claims are processed manually or with outdated systems, the likelihood of mistakes increases. Implementing modern RCM software addresses several common challenges:

- Reducing Phone Calls and Hold Times: With RCM software, tasks like verifying eligibility and managing prior authorizations can be done online, reducing the time spent on phone calls and long hold times with payers.

- Improved Eligibility and Prior Authorization: Technology automates eligibility verification and prior authorization, reducing the risk of errors. This leads to cleaner claims, improved follow-ups, and a better chance of avoiding denials.

- Stay Up-to-Date with Payer Policies: RCM software keeps the revenue cycle team informed about payer policies and the latest billing and reimbursement criteria, ensuring compliance and timely reimbursements.

- Training and Regulation Updates: The software can offer updates and training on government regulations, helping practices navigate any challenges that arise, especially in difficult financial climates.

- Efficient Patient Payment Collection: Using an online patient portal, practices can collect payments quickly, eliminating the need for repeated phone calls or generating multiple statements. This streamlines payment posting and accelerates the payment process.

What to Look for When Selecting an RCM System

Choosing the right RCM system requires careful consideration of several key features that ensure it meets the needs of the organization. Here are the critical factors to keep in mind:

- Comprehensive and Customizable Applications: The system should be versatile, offering applications like patient registration, collections, and easy charting for providers. It should be adaptable to meet the specific needs of the organization.

- Advanced Security Features: Security is a top priority. The RCM system must be equipped with advanced features to protect sensitive patient data from breaches and ensure compliance with privacy regulations.

- Reliable and Easy to Use: The system should be user-friendly and efficient. Systems that are slow, cumbersome, or difficult to manage undermine trust and can disrupt workflow.

- Personalized Customer Support: A reliable RCM system should provide on-site training and user certification. In-person training is often more effective than video tutorials, ensuring users fully grasp how to use the system.

- Smooth Reporting Capabilities: The system should generate detailed reports to track key metrics, such as missing charges, copay collections, and daily appointments, helping managers monitor performance and identify areas for improvement.

How to Know Whether Your RCM Is Performing Well

Monitoring the performance of your RCM system is essential for identifying areas that need improvement. Data analysis is a powerful tool for assessing whether the system is achieving its goals. Key financial and performance benchmarks include:

- Point-of-Service (POS) Cash Collections: This data reflects the collection of copayments at the time of service. Efficient POS collections contribute to the practice’s overall financial health.

- Days in Accounts Receivable (AR): This benchmark tracks how long it takes to collect payment for invoices. A high AR period may indicate delays in the revenue collection process.

- Days in Total Discharged Not Billed: This metric reports the time between a patient’s discharge and the billing of related services. Minimizing this gap helps ensure that revenue is captured promptly.

- Clean Claim Rate: This indicator measures the success of claim submissions, including the frequency of denials and errors. A high clean claim rate means fewer issues with billing, leading to faster reimbursement.

- Bad Debt: This data shows how much of the outstanding debt is unlikely to be collected. Tracking bad debt helps evaluate the effectiveness of the collections process and identify potential weaknesses.

With Rising Costs and Shrinking Margins, Outsourcing RCM is the Best Strategy for Your Practice

Effective revenue cycle management is crucial as healthcare costs rise and profit margins shrink. Financial difficulties and changes in legislation have made it harder for hospitals and small practices to handle RCM internally.

Thousands of healthcare organizations are outsourcing their RCM to experts like MedCare MSO, who can manage revenue cycles more efficiently than internal teams.

With 12 years of experience, MedCare MSO’s AAPC-certified team is well-equipped to manage the shift to high-deductible health plans and the increasing influence of government payers. We analyze your practice’s unique billing challenges and offer tailored solutions to address inefficiencies. This ensures streamlined workflows and improved financial performance.