Have you ever:

- Received an unexpected bill after visiting any healthcare for sudden illness treatment?

- Underwent major surgery at an out-network hospital, only to be hit with a massive surgical bill?

- Had an accident and were shocked by a surprise bill for the air ambulance service to the hospital?

These are some of the nightmare scenarios of Surprise Medical Bills, a problem that has burdened millions of Americans. That’s why the No Surprises Act, which came into effect in 2022 by U.S. federal law, is designed to protect patients’ healthcare costs from unforeseen or unexpected medical bills; particularly in emergency situations where they have little control over who provides their care. However, with the new upcoming revised policies by President Donald Trump, new legislation has been signed to protect the community from surprise medical bills. Trump said, “We’re going to hold insurance companies and hospitals totally accountable.”

The effort gained support from both Democrats and Republicans, who had been overwhelmed by stories of patients facing huge medical bills from emergency physicians, anesthesiologists, and other providers outside their insurance networks, even when care was received at in-network hospitals. So, in this blog post, we’ll explore basically, how the No Surprises Act works and how it helps to protect you from these unexpected bills and often unfair high medical expenses.

What are Surprise Medical Bills?

Surprise medical bills happen when you receive healthcare from an out-of-network provider or facility, often without realizing it until the bill arrives.

For example, if you go to an out-of-network surgeon for any emergency care, and the surgeon charges you $2,000 for a procedure, even though they don’t accept your insurance plan, you could be stuck with a large bill. Your health plan may only cover $600 of the cost, which is its allowed amount for the procedure. This means you could be billed for the remaining $1,400, in addition to any cost-sharing (like a deductible or copay) required for the $600 that your insurance covers. This situation and prices are assumed to be an example of a surprise medical bill, where you end up paying much more than you anticipated.

Basically, surprise bills occur most commonly in emergencies, where patients have little control over who treats them. However, they can also happen in non-emergency situations, like when a hospital uses out-of-network stations during your scheduled complex surgeries to monitor by many specialties or any other medical procedure conducted somewhere else, such as pathology medical billing, radiology medical billing, and laboratory billing services.

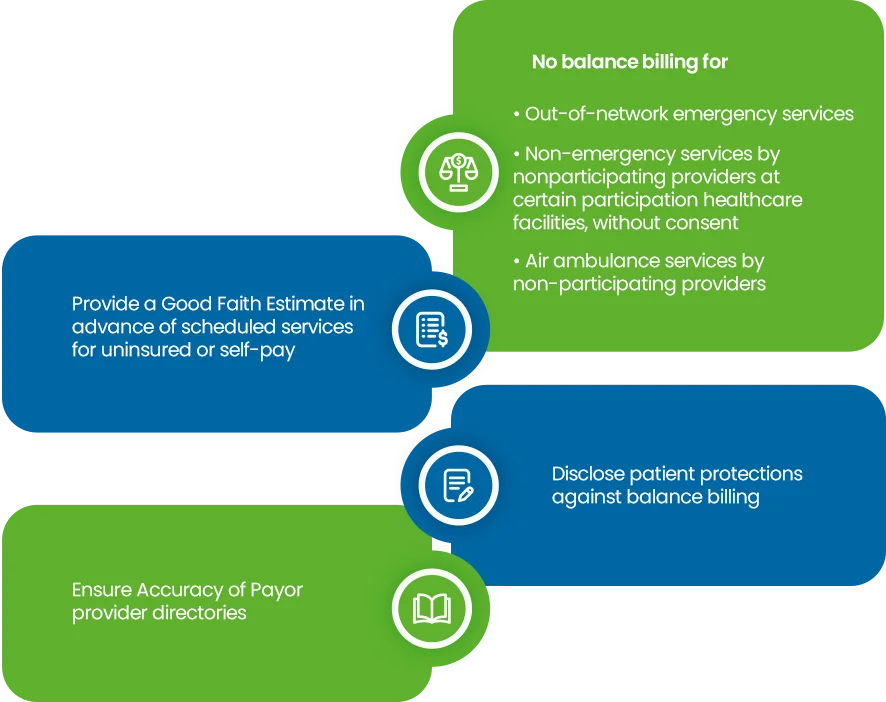

No Surprise Medical Bill Act protects you from Surprise Billing for:

- Out-of-network emergency services.

- Air ambulance services.

- Non-emergency services from out-of-network providers at in-network hospitals, outpatient centers, or surgery centers. It also protects you from payment disputes between your insurance and providers, so you’re not caught in the middle.

Key Features of the No Surprises Act

The No Surprise Billing Act addresses these issues by creating protection for the patients, so that they would not be caught in the middle of billing disputes. Here’s how it works:

1. Emergency Care Coverage

Suppose you need emergency medical care or any other treatment. In that case, the No Surprises Act ensures that you’ll only be responsible for paying the in-network cost-sharing amount (like copays or deductibles) based on your insurance plan, even if the hospital or provider you’re treated by is out-of-network. This tackles a common rising issue where there will be no more surprise charges or any other balance bill for emergency care services, whether you’re treated at an in-network (not associated with your insurance payer) or out-of-network facility.

2. Non-Emergency Services at In-Network Facilities

In addition to any emergency care, the new law policies also cover non-emergency services provided at in-network stations. For example, if you go to a hospital that’s in your insurance network, but an out-of-network anesthesiologist or radiologist is called to treat you for further medical procedures, you won’t have to pay for the entire bill in that case. Your insurance plan will cover these costs at the same in-network rates, saving you from unexpected out-of-pocket expenses.

3. Ban on Balance Billing

Before the No Surprises Act, many patients faced balance billing, where providers would charge them for the difference between what insurance paid and what the provider actually billed. The No Surprise Medical Bill Act bans this practice for both emergency services and non-emergency services at in-network facilities. That means you will no longer be asked to pay for the remaining balance between what your insurance covers and what an out-of-network provider charges.

4. Air Ambulance Services:

For emergency air ambulance transport (not ground ambulances), you’re protected from any extremely high out-of-network bills. Even if the air ambulance service is out-of-network, your cost will not be higher than the in-network service (deductibles, copays, coinsurance) charges.

5. Transparent Communication

The act also requires health insurers to be transparent about what is covered, including the costs patients can expect to pay for out-of-network services. Hospitals and service providers must give patients a clear estimate of their costs before they receive treatment, and patients will be notified in advance if a non-network provider will be involved in their care as well.

Ensure your practice is no surprise act compliant

Does the No Surprises Act Cover All Medical Bills?

The No Surprises Act covers most emergency and non-emergency services from out-of-network providers at in-network facilities, and out-of-network air ambulance services.

However, it doesn’t cover all unexpected or high medical bills. You can still be billed for services not covered by your plan, and the protections don’t apply to non-emergency services at out-of-network facilities. In some cases, you may waive these protections if you are notified and consent.

What does the No Surprises Billing Act do?

- The act protects patients from paying high amounts for any emergency care in out-of-network, even when the treatment is billed outside of your prior authorizations plan.

- This protection can save individuals and families thousands of dollars or any other unexpected costs.

- It helps to remove financial uncertainty, allowing patients to focus on their health, without worry about massive medical bill charges.

- The No Surprises Act creates more fairness in the healthcare system, while ensuring insurance plans and healthcare providers negotiate costs, so patients aren’t left with the bill.

- Requires providers to provide a notice explaining the billing protections and the contact information for reporting any violations of these act protections.

What to do if you receive a Surprise Bill after the No Surprises Act

Although the No Surprises Act provides protections, sometimes issues may still arise. Here’s what you should do if you receive a surprise medical bill:

- Check Your Bill: Review the bill carefully to ensure it’s a surprise bill. If you’re charged for out-of-network emergency services that should be covered under the act, you may be able to file a complaint against the charge.

- Contact Your Insurance Company: Reach out to your payer- insurer to discuss the bill. They can confirm whether the charges should be covered or not and help resolve any further issues.

- File a Complaint: If the issue isn’t resolved through your insurance company, you can file a complaint with the Federal No Surprise Act or your state’s consumer protection agency. Or visit the U.S Department of labor’s publication, filing a claim for your health benefits.

- Negotiate: In some cases, it may be possible to negotiate directly with the provider to reduce the cost of the bill.

Tip:

Number of online resources available, including state insurance commissioners and independent consumer assistance programs, that can guide you through this online complaint process at CMS, or contact No Surprises Helpdesk at 1-800-985-3059, in case you may receive any surprise bill.

Challenges and Limitations of the No Surprises Act

While the No Surprises Act has made significant impact on protecting patients financial cost, there are still some challenges to be aware of:

- Gaps in Coverage: The act doesn’t cover all out-of-network situations, such as when a patient voluntarily seeks care from an out-of-network provider in any non-emergency situation.

- Negotiation Process: Clash over out-of-network charges may still arise, as healthcare providers and insurers negotiate payments, potentially leading to claim denials and delays.

- Enforcement Issues: The No Surprise Act is built on state law enacted in 33 states. According to some studies, experts warn that there may still be hiccups in enforcement of the act around the state level, especially with hospitals and insurers not fully complying.

Tip for Notice & Consent Exception:

Under the No Surprises Act, you may be asked to waive your balance billing protections in certain situations, such as scheduling non-emergency services at an in-network facility with an out-of-network provider or needing post-stabilization care after an emergency. If asked, you’ll receive a notice and consent form explaining the protections you’re giving up and the potential out-of-network costs. Be sure to read the form carefully before signing! In emergency situations or for certain services notice and consent can’t be used to waive protections.

The No Surprises Act marks an important shift in how healthcare revenue cycles are managed, offering much-needed protection to patients from unexpected and high-cost medical bills. With the new rules sets, ensuring fairer billing procedures and clear transparency with No Surprise Act; healthcare billing system will be less stressful for millions of Americans.

Still, if you find yourself facing an unexpected medical bill, remember your rights under the No Surprises Act are valid. That you have the authority by the law side to challenge every unfair medical billing charge and seek help from federal policymakers whenever you need.