Are you considering outsourcing your medical billing to a new vendor? A switch can raise collections, cut denials, and free staff yet one overlooked detail can stall cash flow for weeks. Providers worry most about three facts: total cost, expected downtime, and true payback time. Hidden setup fees, data-migration errors, or a slow clearinghouse link can cancel the gains you expect.

This guide “Know Everything Before Switching Medical Billing Companies: Cost, Downtime & Payback Explained” spells out every step clearly. You will compare pricing models offered by outsourced billing services, learn how a parallel go-live keeps claims moving, review EDI test checklists, and calculate return on investment based on cleaner claims and faster payments. Read on to see how the right medical billing company can improve revenue without risking compliance, staff morale, or patient trust.

Tired of Billing Delay?

Why Practices Think About Switching?

Practices think about switching medical billing companies when they see signs of trouble. For example:

- Money comes in more slowly.

- Too many claims get denied.

- Fees go up, but help does not improve.

- Staff must fix errors again and again.

- Reports are unclear, or communication is poor.

These warning signs can hurt a practice’s health. When revenue falls or billing errors grow, the team feels stress. Also, if the billing partner does not share clear reports or answer questions, trust can drop. Watching for these signs early can help avoid bigger problems.

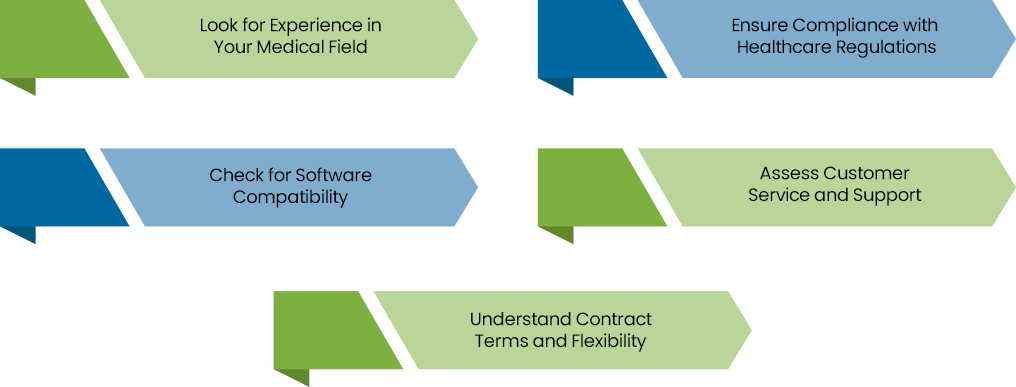

Key Factors to Consider Before Switching Medical Billing Companies in USA

The following are the key factors that a healthcare provider should consider when switching medical billing companies. First, ensure that the medical billing service provided by the new company meet all your needs, from accurate claim submissions to efficient follow-up processes. This will help avoid gaps in revenue cycle management and ensure smoother operations.

Understanding Cost Before Switching

Cost is key when thinking of a new medical billing services partner. First, list what you pay now. Then ask a potential partner for their fees. Some billing teams charge a percentage of money they collect. Others charge per claim or per code. A smart model is “pay-for-paid,” where you pay only when they collect for you. This helps avoid surprise bills later. Ask for a clear fee list, setup costs, monthly fees, and extra fees for tasks like denied claim appeals. Having clear fee info helps you compare offers and pick the best medical billing company fit.

Spotting Hidden Fees

Hidden fees can appear later. For example, a billing team may add fees for extra tasks, such as appealing denied claims or custom reports. To avoid this, get a written fee list. Ask: “What is included? What costs extra?” Many good medical billing companies bundle denied claim appeals and software setup in base fees, so there are no surprises. If a partner will not share full fee details, be careful. Clear fee info helps you see the true cost and avoid surprises.

Measuring Downtime Risk

When you change billing partners, downtime means billing slows or stops for a while. Even a short break can delay payments and hurt cash flow. Good outsourced billing services plan data moves and test steps before full switch. They often run old and new systems side by side until the new one works well. Ask potential partners for a detailed transition plan. The plan should list tasks, dates, and who does each job. A clear plan cuts downtime risk and keeps claims flowing so the practice keeps getting paid.

Planning Data Migration

Moving patient data and open claims needs care. Strong billing teams first check your data for missing or wrong info. Then they load data into the new system and test it before full go-live. Ask new teams to share their data move steps, showing tasks, dates, and people in charge. This way, you know how they keep data safe and correct, avoiding lost claims or delays. Engaging with a medical billing consulting expert during the transition can provide valuable insights, helping to ensure a smooth data migration and seamless integration into the new system.

Calculating Payback Time

Payback time is how long it takes until savings cover new fees and bring extra benefits. To find it:

- List one-time costs (setup fees, data move fees).

- List ongoing fees (monthly billing charges).

- List savings (less staff cost, fewer errors, fewer denials).

- List revenue gains (faster payments, more claims collected).

For example, if you save $1,200 per month on staff but pay $900 monthly to a new billing partner, the net gain is $300 per month. If setup costs $900, payback is about 3 months ($900 ÷ $300). Use reported improvement rates like 20–30% faster reimbursements or 10% higher collections to refine estimates. Knowing payback helps you see when the switch starts to help your practice’s finances. To gauge the success of the new billing company, establish key performance indicators (KPIs) such as claims accuracy, collection speed, and denial rates. These metrics will give you a clear view of the transition’s impact on your bottom line.

Examining Technology and Automation

Modern billing uses software that sends claims electronically, checks patient insurance eligibility, and flags errors before submission. Many billing teams use rule-based or simple AI tools to scrub claims. Ask if the partner’s software works with your current EMR or practice system. Integration cuts out double work. Automating the generation of patient billing statements not only speeds up processing but also minimizes errors, ensuring that statements are clear and accurate for both patients and healthcare providers.

Ensuring Compliance and Security

Billing data is private; laws like HIPAA protect it. Medical billing companies follow HIPAA rules and CMS guidelines. They use encryption, secure servers, and regular security checks. Ask them how they train staff on privacy rules. Ask how they handle any security incidents. A partner with strong compliance protocols will regularly conduct compliance audits to ensure they meet HIPAA and CMS guidelines, safeguarding your practice from potential risks and penalties.

Matching Specialty Expertise

Each medical field uses special codes and rules. A cardiology clinic needs coders who know heart codes. A dermatology practice needs skin codes. Billing teams that serve many specialties often match coders by specialty. Ask: “Do you have coders for my specialty?” If they lack experience, errors and denials can rise. A good match cuts mistakes and speeds payment.

Reviewing Accounts Receivable Recovery

Old unpaid claims harm cash flow. Top medical billing companies offer AR recovery. They chase old claims, even those past 120 days. They analyze which claims to chase first and follow systematic appeals and follow-ups. Many report cutting outstanding AR by up to 30%. Ask: “How do you choose which accounts to chase? What steps do you take to appeal denials?” Strong AR recovery brings more money without extra staff.

Assessing Denial Management

Denied claims cost time and money. Good billing partners use a process:

- Identify why claims are denied.

- Fix the root cause, like wrong code or missing info.

- Appeal when possible.

- Use data to prevent future denials.

Checking Customer Support

When a billing issue arises, you need help fast. Good billing teams offer a dedicated account manager, regular check-ins, and quick responses by phone or email. Ask partners for average response times and client feedback. If possible, talk to a current client to learn how support works in real life. Good support means small issues do not turn into big money losses.

Calculating Return on Investment

Think about the return on investment. Will the benefits of switching outweigh the costs? Look at factors like increased revenue, faster reimbursements, and improved cash flow. Calculate the potential ROI before making a decision.

See How Much You Could Save!

Risk and Mitigation

Switching has risks: data errors in transfer, unexpected downtime, and staff confusion. To reduce risk:

- Pick a partner with a clear, tested onboarding plan and a good track record.

- Plan to run the old and new billing side by side briefly to catch issues.

- Train staff early and offer quick support channels.

- Set clear milestones and regular check-ins during transition.

These steps cut surprises and keep revenue safe. When you consider outsourced billing services, such planning is key.

Common Mistakes to Avoid

- Skipping Fee Details- Not getting a full fee list can lead to surprise costs.

- Ignoring Data Quality- Bad data moves can lose or delay claims. Always audit data first.

- Not Checking References- Failing to talk to current clients may hide service issues.

- Underestimating Training- Staff need clear help on new processes.

- No Downtime Plan- Lack of a transition plan can cause long billing breaks.

Benefits of Switching

Switching to a reliable medical billing company offers numerous benefits.

Improved Cash Flow

When a billing company does a good job, your office gets paid faster and more fully. If you switch to a partner that cleans up mistakes and sends correct claims, you can see more money each month. Many practices switch because they want better revenue through revenue cycle management services. Best billing companies like MedCare MSO, report that many clients see about 15–20% more revenue in the first months after switching.

Reduced Denials

A denial means insurance says “no” to a claim and sends it back for fixes. Too many denials slow payments and take staff time. By switching to a billing team with experts who know the right codes, you get fewer denials. Good billing partners match coders to your specialty so claims go through the first time. MedCare MSO says around 88% of claims pass on the first try when they provide specialty-specific coders to their clients, which reduces denial headaches.

Less Downtown During Change

Switching billing companies can cause a pause in billing work. If billing slows or stops for days, payments get delayed. A good billing partner plans data moves carefully and tests before going live. They may run old and new systems side by side until the new one works well.

Clear and Fair Fees

Hidden fees can surprise you later. A clear billing partner shows all costs up front, like setup fees, monthly fees, and extra fees for things like denied claim help. Many top firms use a “pay-for-paid” model, meaning you pay only when they collect money for you.

Ready to switch? Let MedCare MSO simplify your billing!

Conclusion

Switching medical billing companies is a big step. You must think about cost, downtime, and payback time. Check fees, data migration, technology, compliance, specialty expertise, reporting, AR recovery, denial management, onboarding, support, scalability, and real results. Use clear questions and ROI models. Watch for warning signs like slow payments, many denials, unclear fees, or poor service. Plan the switch well to reduce risks. If you find a partner that follows these best practices, you can switch with less worry. The right outsourcing medical billing or medical billing services partner helps your practice focus on patients, get paid faster, and grow.