Small practice owners face a critical dilemma of maintaining quality patient care while managing complex revenue operations. Unlike hospital systems with dedicated billing departments and specialized staff, small practices operate with limited teams. These teams learn revenue cycle management through costly trial and error.

A single coding error that represents merely 0.1% of a hospital’s monthly volume could constitute 5% of your practice revenue. Thus, small practices need a framework that addresses such challenges, all while having limited administrative resources. Here’s a comprehensive RCM checklist to eliminate such issues from happening in the first place.

Complete Small Practice End-to-End RCM Checklist

Generic RCM advice doesn’t work for small practices. You face constraints that hospital systems never encounter. This approach focuses on high-impact activities that deliver measurable results without massive resource investment. Each step includes action items your staff can implement immediately using existing systems.

Pre-Appointment Preparation

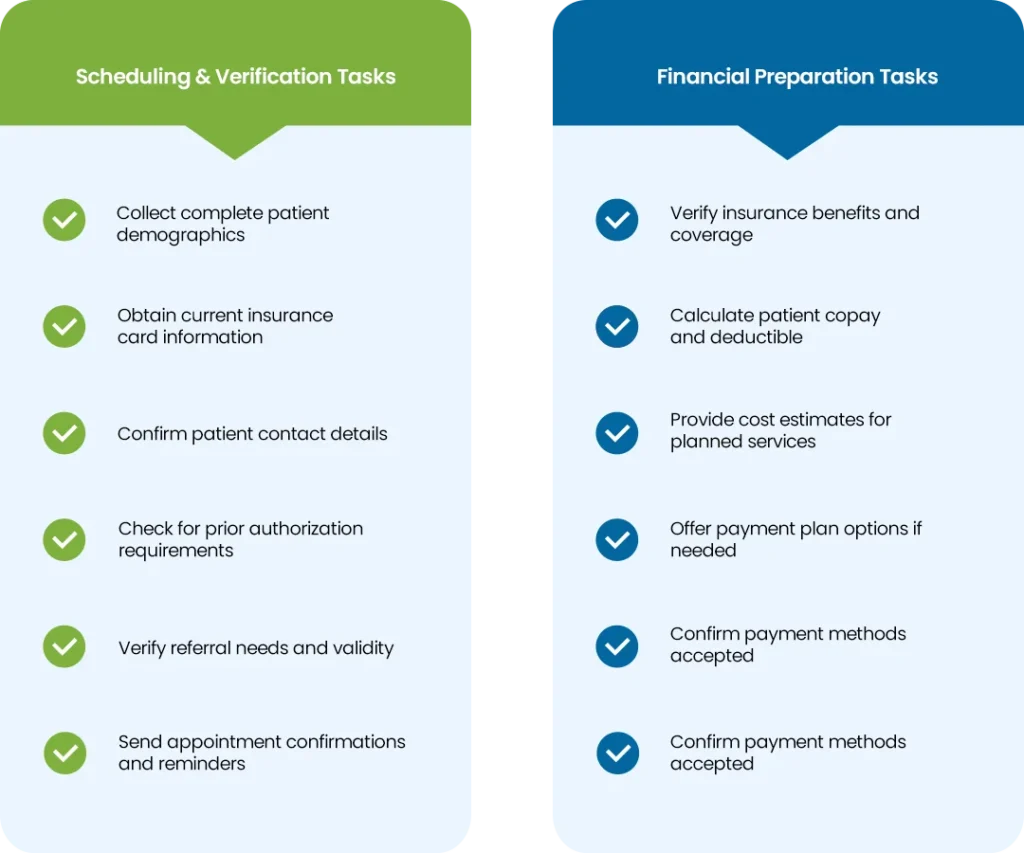

Healthcare revenue cycle management services actually begins during the scheduling phase. This presents your biggest opportunity to prevent claim denials and payment delays. Collect complete demographic information during scheduling calls, verify current insurance details, and confirm coverage requirements upfront.

Patient responsibility estimates matter more than most practices realize. When patients understand their financial obligations before arriving, they come prepared to pay. This upfront investment prevents most claim denials that result from incorrect patient information or expired insurance policies.

Pre-Appointment Preparation Checklist

POS Collections and Documentation

Point-of-service collections are your most efficient revenue capture opportunity, patients are present and engaged with your care delivery. Accurate documentation during the encounter creates the foundation for proper coding and claim reimbursement.

Train front desk staff to collect copays, deductibles, and estimated patient portions before or immediately after service completion. Clinical staff must record all services provided with the specificity needed for accurate coding.

Point-of-Service Checklist

Charge Capture and Coding Review

Every billable service and supply needs to reach your claim through comprehensive charge capture. Accurate coding maximizes reimbursement and minimizes denials. Daily charge reconciliation is essential, compare scheduled appointments against entered charges to identify missed services.

This prevents revenue leakage from unbilled services. It also reduces costly claim rejections due to coding errors.

Charge Capture and Coding Checklist

Struggling with coding accuracy and reviews?

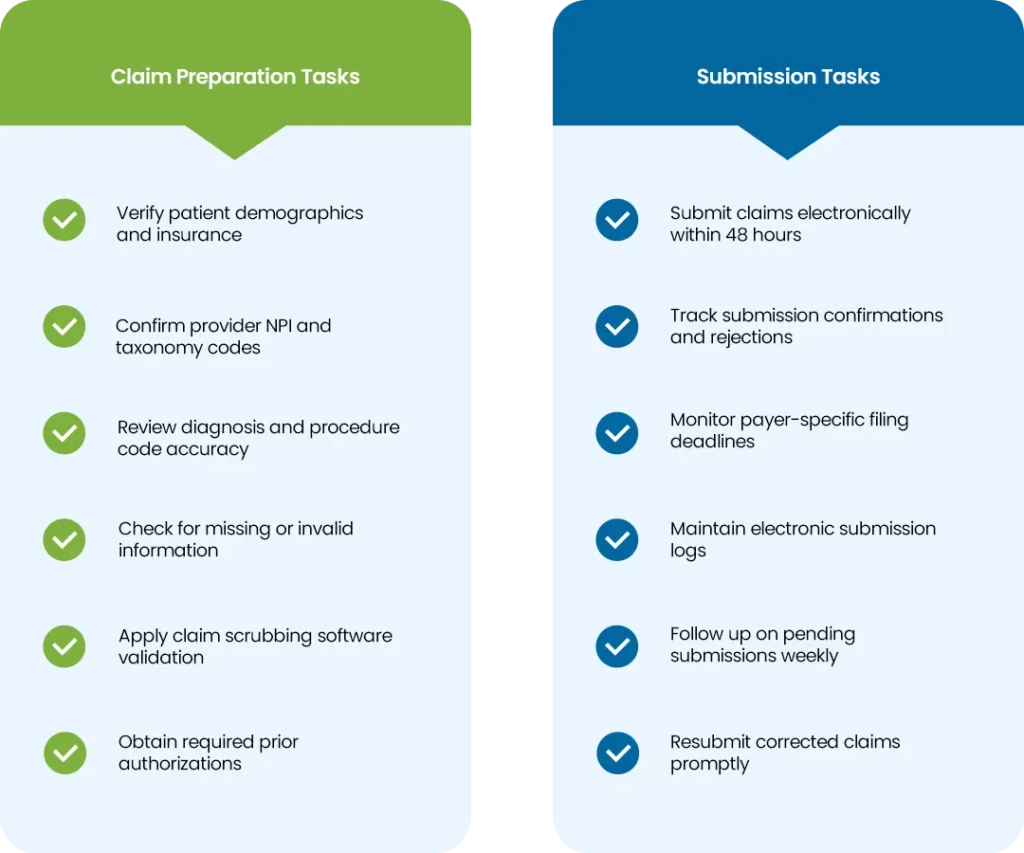

Claim Preparation and Submission

Clean claim preparation eliminates the primary cause of payment delays by ensuring accuracy before submission. Timely filing protects your practice from lost revenue due to missed deadlines.

Pre-submission claim scrubbing protocols verify patient demographics, insurance information, and coding accuracy. Submit claims within one to two business days whenever possible. This reduces claim rejections by up to 80% and accelerates payment cycles significantly.

Claim Preparation and Submission Checklist

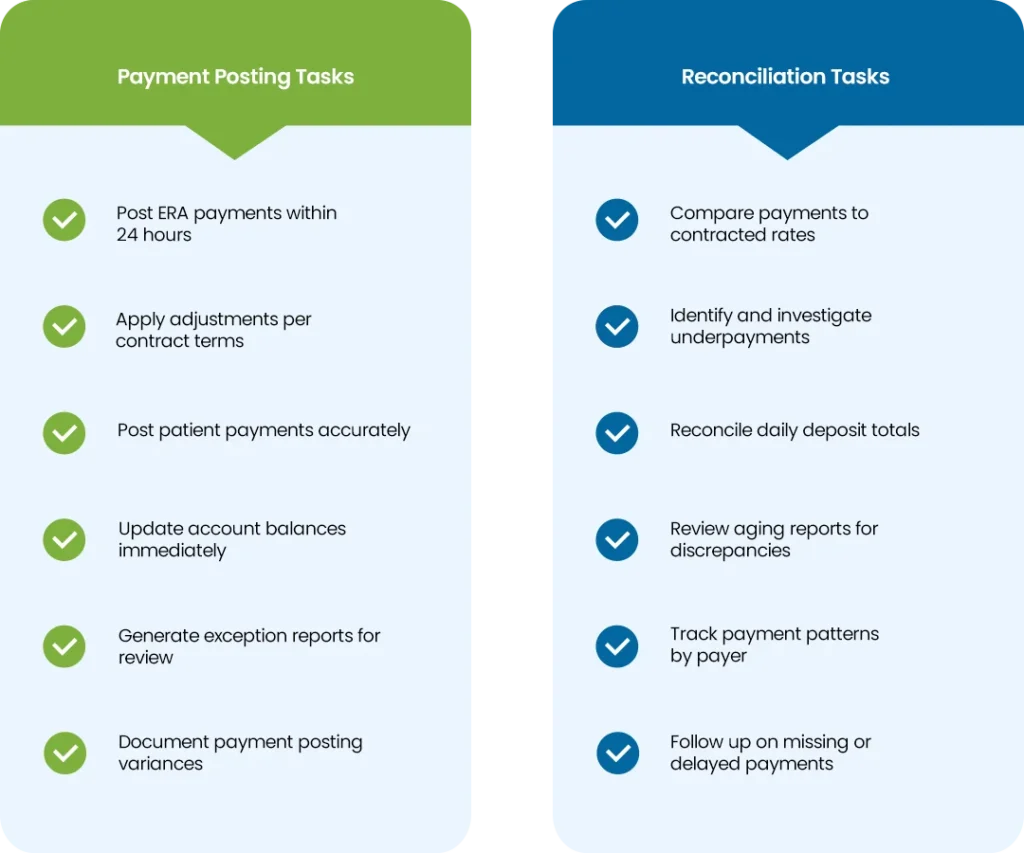

Payment Posting and Reconciliation

Accurate payment posting and systematic reconciliation identify underpayments and processing errors that cost small practices thousands annually. Post electronic remittance advice data promptly. Compare paid amounts against contracted rates and fee schedules to spot discrepancies requiring investigation.

This disciplined approach ensures full contracted reimbursement while maintaining clean accounts receivable aging.

Payment Posting and Reconciliation Checklist

Denial Identification and Resolution

Prompt denial identification and resolution processes recover revenue that would otherwise be written off. Root cause analysis prevents recurring issues. Review denial reports daily to categorize reasons and assign resolution priorities. Establish standard appeal timelines that protect your practice from missed deadlines.

This proactive approach typically recovers 60-70% of initially denied claims while strengthening overall revenue cycle performance.

Denial Identification and Resolution Checklist

Patient Statement Generation and Follow-up

Clear patient statements and consistent follow-up protocols significantly improve collection rates. They also maintain positive patient relationships through professional communication. Generate statements promptly after insurance processing with clear explanations of services provided and available payment options.

Structured follow-up schedules that escalate based on account age typically increase patient collection rates by 40-50% compared to sporadic billing efforts.

Patient Statement and Follow-up Checklist

Monthly Performance Monitoring and Cleanup

Regular performance monitoring and account cleanup maintain healthy revenue cycle metrics. This identifies improvement opportunities before they impact cash flow. Monthly review of key performance indicators includes days in accounts receivable, denial rates, and collection percentages.

Account cleanup resolves aged balances and updates account statuses. This disciplined oversight ensures peak revenue cycle efficiency and supports informed business decisions.

Monthly Performance Monitoring Checklist

When to Handle RCM In-House vs When to Outsource

Managing revenue cycle functions internally versus outsourcing to specialized vendors represents a critical strategic choice. This impacts your practice’s financial performance and operational efficiency.

When to Keep RCM In-House

In-house RCM control makes strategic sense when your practice meets specific benchmarks: denial rates below 5-10%, days in accounts receivable under 45 days, clean claim submission rates above 90%. Administrative costs should stay below 12% of total revenue. Your team needs consistent knowledge in coding and billing regulations. Your patient base should value direct communication with familiar team members.

When to Outsource RCM Operations

Outsourcing becomes preferred when performance indicators suggest internal challenges or resource constraints. Poor performance metrics include denial rates exceeding 10% or days in accounts receivable surpassing 50 days. High administrative costs occur when RCM functions consume more than 15% of practice revenue despite optimization efforts. Staffing challenges make it difficult to recruit and retain qualified billing personnel.

Can’t handle revenue cycle management alongside patient care?

Conclusion

Implementing this comprehensive RCM approach requires systematic strategy, but rushing through everything simultaneously sets practices up for failure. Baseline assessment using monthly monitoring metrics reveals which phases need immediate attention rather than guesswork about priorities.

Most practices attempt to overhaul their entire revenue cycle simultaneously, a critical mistake. Revenue loss typically concentrates in pre-appointment preparation and denial management. Address these areas first before expanding to other components. Timeline matters more than speed. Allow your team to master each phase completely before advancing to the next step.