Medical coding errors cost the U.S. healthcare system roughly $36 billion annually, with up to 12% of claims containing inaccuracies, a level of loss that puts many practices at risk. With 420 CPT updates in 2025 alone, including 270 new codes, 112 deletions, and 38 revisions, and quarterly HCPCS updates, accurate code selection has never been more critical.

A single misinterpreted code can be the difference between receiving $150 in reimbursement or $0. Such errors often prompt audits that can cost practices tens of thousands of dollars in legal fees and staff time, even when practices are ultimately found compliant.

This guide provides healthcare providers with the practical skills needed to decode CPT and HCPCS codes accurately, make informed selection decisions, and protect practice revenue through proper code interpretation.

Maximize Collections With Accuracy

Our specialists improve coding precision to boost reimbursements and reduce denials.

Get a Free Coding AuditBreaking Down Procedure Code Formats

Understanding the structural logic behind CPT and HCPCS codes is the foundation of accurate code selection.

CPT Five-Digit Numbers Format

CPT codes follow a logical five-digit numeric structure that reveals information about the service category and complexity:

Code Range System:

The six main sections of CPT Category I codes and their sequences are:

- Evaluation and Management (98000-98016, 99202-99499)

- Anesthesia (00100-01999, 99100-99140)

- Surgery (10004-69990) is further broken into smaller groups by body area or system within this code range

- Radiology (Including Nuclear Medicine and Diagnostic Ultrasound) (70010-79999)

- Pathology and Laboratory (80047-89398)

- Medicine (90281-99199, 99500-99607)

CPT Codes Categories:

- CPT Category I: The largest body of codes, consisting of those commonly used by providers to report their services and procedures.

- CPT Category II: Supplemental tracking codes used for performance management.

- CPT Category III: Temporary codes used to report emerging and experimental services and procedures.

Example Decoding Process:

Take CPT code 99213:

- 99: Indicates Evaluation & Management section

- 2: Specifies office/outpatient visits

- 13: Identifies established patient, moderate complexity

The numeric progression within ranges typically indicates increasing complexity or time requirements. Code 99213 requires more work than 99212, but less than 99214.

Category Identification:

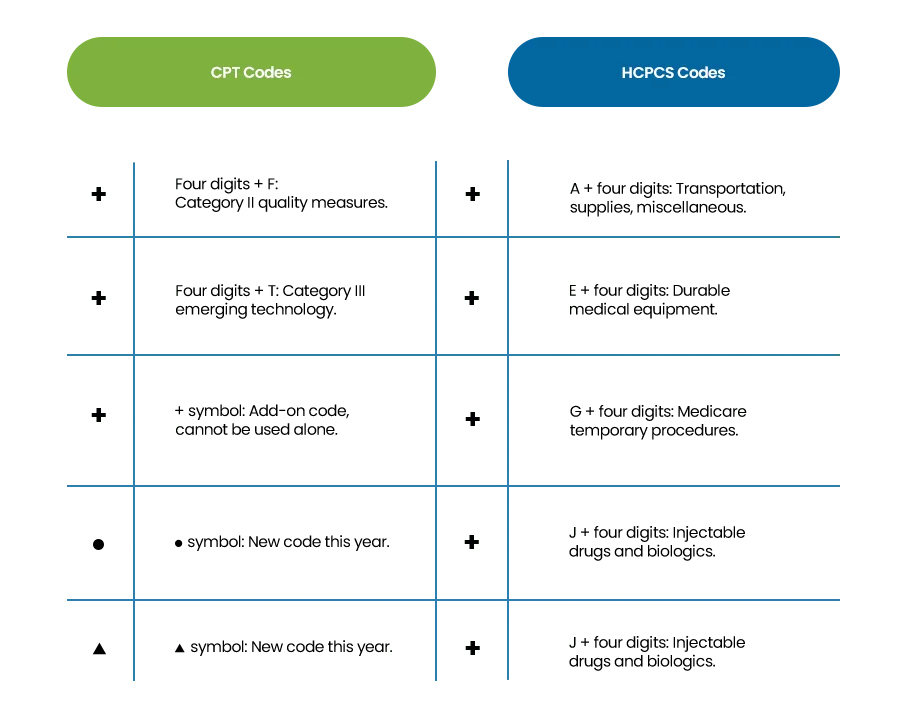

- Category I: Standard five-digit codes (99213, 27447)

- Category II: Four digits + letter “F” for quality measures (4000F)

- Category III: Four digits + letter “T” for emerging technology (0001T)

HCPCS Letter-Number Combinations

HCPCS operates as a two-tier system where understanding both levels is essential for accurate code interpretation:

HCPCS Level I

HCPCS Level I consists entirely of CPT codes, the same five-digit numeric codes maintained by the AMA. These codes are referred to as Level I codes when used in Medicare or Medicaid billing, and these CPT codes technically become HCPCS Level I codes when utilized for reimbursement under federal programs:

Example: CPT code 99213 becomes HCPCS Level I code 99213 when billing Medicare

- Structure: Five digits, all numeric

- Usage: Physician services, procedures, evaluations

- Interpretation: Same as the CPT decoding process

HCPCS Level II

Level II uses a more direct categorization system where the first letter immediately identifies the service type:

Key Letter Categories:

- A-codes: Transportation and medical supplies (A0426 = ambulance service)

- B-codes: Enteral and parenteral therapy (B4034 = enteral feeding supply)

- C-codes: Outpatient PPS temporary codes (C1725 = catheter)

- E-codes: Durable medical equipment (E0118 = crutches)

- G-codes: Medicare temporary procedures (G0442 = annual wellness visit)

- J-codes: Injectable drugs and biologics (J0135 = adalimumab injection)

- L-codes: Prosthetics and orthotics (L3300 = ankle foot orthosis)

Example Decoding Process: Take HCPCS Level II code J0135:

- J: Immediately identifies the injectable drug category

- 0135: Specific identifier for adalimumab, 20 mg dose

Interpreting Both Levels Together: Many services require both HCPCS levels:

- Injection visit: 99213 (Level I for office visit) + J0135 (Level II for drug)

- Surgery with device: 27447 (Level I for procedure) + L8630 (Level II for implant)

- Therapy with equipment: 97110 (Level I for therapy) + E0738 (Level II for equipment)

The four-digit number in Level II provides specific identification within each letter category, often including dosage, size, or duration information.

What Code Structure Tells You

As a healthcare provider, it is also important to understand the code structure along with the format identification of CPT and HCPCS. This knowledge is crucial to understanding the billing rules, complexity levels, and payer requirements.

| CPT Structure Insights | HCPCS Structure Insights |

|---|---|

| Higher numbers within ranges typically indicate more complex procedures. | Letter category determines billing rules and documentation requirements. |

| Sequential codes often represent related procedures of increasing intensity. | Numbers often specify exact quantities, dosages, or equipment specifications. |

| Add-on codes (+) cannot be reported without a primary procedure code. | Temporary codes (C, G, Q series) may have limited coverage periods. |

| Modifier-exempt codes have specific billing restrictions. | Equipment codes frequently include rental vs. purchase distinctions. |

Choosing Between CPT and HCPCS for Similar Services

When both CPT and HCPCS codes exist for the same or similar services, choosing the wrong code can result in denials, reduced reimbursement, or audit triggers.

Medicare Preference for HCPCS Level II

Medicare consistently favors HCPCS codes when both options exist. This is especially true for:

- Equipment and supplies: Always use E-codes for durable medical equipment.

- Injectable drugs: J-codes are required for medication billing.

- Transportation: A-codes mandatory for ambulance services.

- Prosthetics: L-codes required for coverage.

Example: A patient needs a wheelchair after surgery. Use E1130 (wheelchair HCPCS code) for Medicare billing, not just the CPT training code.

Commercial Payer Variations

Commercial insurers often prefer CPT codes over HCPCS alternatives. They may:

- Pay differently for the same service depending on code type.

- Require prior authorization for HCPCS but not CPT.

- Have network restrictions for certain HCPCS codes.

Specificity Advantages

HCPCS codes often provide more detailed descriptions:

- Drug codes: Specify exact dosages (J0135 = adalimumab 20mg vs. generic CPT injection code).

- Equipment codes: Include specific device features.

- Service codes: May specify patient populations or timing.

This specificity reduces claim ambiguity and improves approval rates.

Reimbursement Rate Differences

Payment can vary significantly between code types:

- Missing HCPCS drug codes: Can lose $1,000+ per injection.

- Equipment billing: Separate HCPCS codes add monthly rental revenue.

- Bundling differences: Some codes package services differently.

How Coding Errors Cost Money

With 270 new CPT codes introduced in 2025 and quarterly HCPCS updates, practices face increased error risk:

- Deleted code usage: Submitting obsolete codes results in automatic denials.

- New telehealth codes: Using old E/M codes instead of the new 98000-98015 series.

- AI procedure coding: Missing new Category III codes for AI-assisted procedures.

Direct Financial Losses:

- Claim denials: Average $150-$500 per denied claim in lost revenue.

- Undercoding: Using lower-paying codes costs 15-25% of potential revenue.

- Audit penalties: $50,000+ in legal and administrative costs.

- Recoupment demands: Medicare can demand the return of payments up to 6 years retroactively.

Hidden Costs:

- Staff time: 2-4 hours per denial to research and resubmit.

- Delayed payments: Incorrect codes delay payment by 30-60 days on average.

- Payer relations: Frequent errors can trigger increased scrutiny and audits.

- Reputation risk: Coding errors can affect provider credentialing and contracts.

4 Steps to Bill With Correct Procedure Codes

The difference between getting paid $1,235 and $35 for the same service often comes down to billing with the accurate code. Here’s a simple four-step decision process to identify the correct code to use.

Step 1: Service Identification

- Determine if the service is a physician procedure or a non-physician service.

- Identify if supplies, equipment, or medications are involved.

- Check if the service has both CPT and HCPCS options available.

Step 2: Payer Analysis

- Review payer-specific requirements (Medicare often mandates HCPCS).

- Check coverage policies for the specific service.

- Verify if prior authorization affects code selection.

Step 3: Code Selection

- Choose CPT when: Reporting physician services, standard procedures, E/M visits.

- Choose HCPCS when: Billing supplies, equipment, injections, and transportation.

- Use both when: Procedure requires separate billing for supplies and physician work.

Step 4: Validation

- Confirm code description matches the service provided.

- Verify appropriate modifiers for the selected code type.

- Check bundling rules and global period considerations.

Quick Code Interpretation Guide

Identifying Coding Errors and Tackling Denials

When coding errors lead to claim denials, swift correction protects cash flow and prevents compounding problems. The impact of medical billing errors on patient trust is significant. Incorrect billing can lead to confusion and frustration, which may damage the relationship between the provider and the patient. Incorrect coding also undermines ICD-10-CM linkage, impacting the medical necessity of the service.

Denial Analysis Process:

- Identify error type: Code selection, modifier, or documentation issue.

- Determine the correct code: Research proper CPT vs. HCPCS choice.

- Check payer policies: Verify current coverage requirements.

- Assess documentation: Ensure adequate support for corrected code.

Common Denial Scenarios and Solutions

“Code not valid for this provider type”

- Cause: Used CPT when HCPCS is required for supplier billing.

- Solution: Resubmit with the appropriate HCPCS code.

- Prevention: Verify provider enrollment and billing capabilities.

“Services not separately billable”

- Cause: Used both CPT and HCPCS for bundled service.

- Solution: Research bundling rules and resubmit the correct combination.

- Prevention: Understand global periods and bundling policies.

“Invalid code combination”

- Cause: Incompatible CPT and HCPCS codes billed together.

- Solution: Use NCCI edit tools to verify valid combinations.

- Prevention: Implement pre-submission claim validation.

Healthcare providers can get immediate help through CMS.gov for official HCPCS guidance and AMA CPT Assistant for comprehensive CPT support.

Conclusion

Mastering CPT vs HCPCS decoding differences requires a systematic approach and ongoing education. The financial impact makes this investment essential. Providers should assess coding accuracy, train staff, update systems, and monitor performance improvements.

Long-term success demands maintaining current knowledge, building expert relationships, investing in technology, and documenting decisions for audit protection. Providers mastering these skills protect revenue while positioning for regulatory success.