Every day, around 200 million claims get denied, which means roughly one in seven claims doesn’t get approved. Of these, about 27% are turned down because of problems with patient registration and eligibility.

Dealing with these denials can be expensive, with each rejected claim costing an average of $25 to manage. This can create significant cash flow issues for practices’ revenue cycle management (RCM).

Issues with eligibility coverage not only drive up billing costs but also delay the revenue collection process, disrupting the entire revenue cycle.

Using a reliable insurance verification method can help avoid denials, simplify medical billing, and improve your bottom line.

This guide will walk you through different methods for checking a patient’s Medicare insurance eligibility.

What is Medicare Coverage?

Medicare is a federal health insurance program that was established in 1965. It provides coverage for people aged 65 and older, regardless of their work history, income, or health status. Medicare is overseen by the Centers for Medicare and Medicaid Services (CMS), which is part of the U.S. Department of Health and Human Services. It operates under the guidance of Congress.

Medicare isn’t meant to cover all medical costs; its goal is to assist with a portion of expenses. Beneficiaries are still responsible for some out-of-pocket costs, such as deductibles, copayments, and any services that Medicare doesn’t cover. It is important to periodically verify a Medicare beneficiary’s eligibility through Medicare Administrative Contractors (MACs) and their online portals to ensure accurate billing for services provided under Medicare.

Medicare is made up of four parts:

- Part A (Hospital Insurance): This helps cover the costs of inpatient hospital care, skilled nursing facility care (after a hospital stay), some home health care, and hospice care.

- Part B (Medical Insurance): This helps with expenses related to doctor visits, various medical services, and supplies that Part A doesn’t cover.

- Part C (Medicare Advantage): Formerly known as Medicare + Choice. This plan is available in many areas and allows those with Part A and Part B to get all their healthcare services through a single provider organization.

- Part D (Prescription Drug Coverage): This helps cover the cost of prescription medications that doctors prescribe for treatment.

Struggling With Medicare Payments!

Fix eligibility issues to reduce denials and improve Medicare reimbursements.

Understanding Medicare Eligibility

Medicare eligibility is a critical aspect of healthcare management, ensuring that patients receive the necessary medical coverage. Medicare is a federal health insurance program that provides coverage for people aged 65 and older, certain qualified disabled people under age 65, and people of all ages with end-stage renal disease (ESRD). To determine Medicare eligibility, providers must verify a patient’s Medicare beneficiary identifier, also known as the Medicare Beneficiary Identifier (MBI). This unique identifier is used to process Medicare claims and ensure accurate billing.

Why Verify Medicare Coverage?

Verifying Medicare coverage is essential for providers because it helps streamline the revenue cycle and improves the collection process. Verifying the patient’s eligibility using the HIPAA Eligibility Transaction System (HETS) ensures that healthcare services provided are covered and helps prevent unexpected billing issues. According to CompuGroup Medical, manual verification can cost you the equivalent of two patient visits per day, or about $6,000 a year. Switching to electronic verification allows you to save time, money, and effort.

Here’s why verifying Medicare eligibility in advance is so important:

- Checking eligibility upfront increases the chances of claims being approved on the first try and reduces accounts receivable (A/R) days. It means you get paid faster.

- Verifying coverage before providing services helps you understand your patients’ co-pays, co-insurance, deductibles, and out-of-pocket costs, so you can collect payments more efficiently.

- When you verify eligibility early, you can inform patients about their insurance plan details, co-pays, and deductibles in advance. This leads to higher patient satisfaction and fewer disputes over bills.

- Confirming eligibility before providing services helps keep your cash flow steady as it prevents payment delays.

Benefits of Medicare Eligibility Verification

Medicare eligibility verification is essential for healthcare providers to streamline their revenue cycle and improve the collection process. By verifying Medicare eligibility in advance, providers can reduce the risk of denied claims, simplify medical billing, and improve cash flow.

Faster Reimbursement and Cash Flow

Verifying Medicare eligibility can help providers determine the patient’s coverage and benefits, ensuring that claims are processed correctly and reimbursement is received in a timely manner. This can lead to faster reimbursement and improved cash flow, reducing the administrative burden on front-office staff.

Fewer Rejected Claims and Returns

Medicare eligibility verification can also help reduce the number of rejected claims and returns. By verifying a patient’s Medicare coverage and benefits, providers can ensure that claims are accurate and complete, reducing the likelihood of denials and rejections.

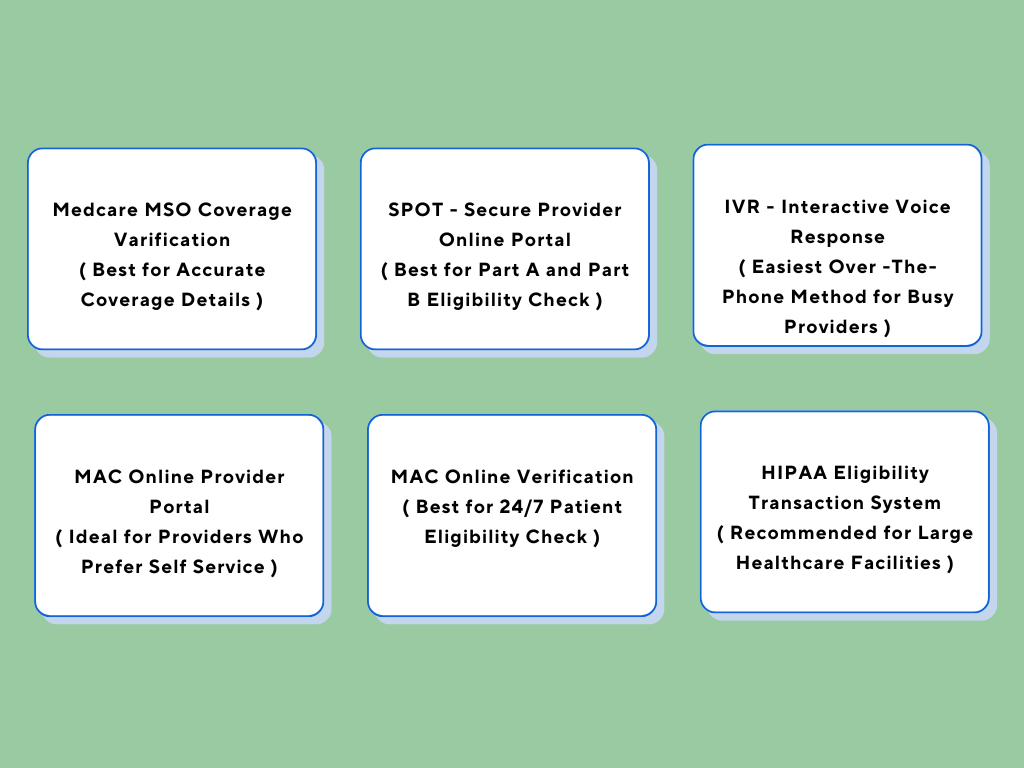

Here are the top 6 methods for providers to verify Medicare’s coverage:

How Do You Check Your Patient’s Medicare Eligibility Status?

Method #1: MedCare MSO Medicare Coverage Verification

- Visit MedCare MSO

2. Fill out the form with your name, email, phone number, and monthly billing, and then hit “SUBMIT NOW.”

3. A MedCare MSO support representative will get in touch with you right away to help confirm your patient’s Medicare coverage.

4. If you prefer, you can also call MedCare MSO at 800-640-6409 for help with verifying Medicare coverage.

Method #2: Using the Secure Provider Online Tool (SPOT)

The Secure Provider Online Tool (SPOT) lets you check claims status and patient eligibility online. It also allows you to look up a Medicare Beneficiary Identifier (MBI).

With SPOT, you can access eligibility information 24/7. This includes details on Part A and Part B coverage, preventive services, deductibles, therapy caps, inpatient and hospice care, home health, Medicare secondary payer (MSP), plan coverage, and claim status for up to a year.

To check patient eligibility with SPOT:

- Select “Eligibility” from the top drop-down menu.

- A pop-up will appear requesting the following information:

- Last Name of Beneficiary

- Medicare Beneficiary ID

- First Name of Beneficiary

- Beneficiary’s Date of Birth

- Date(s) of Service

Note: You can narrow your search to the dates when the service will be provided or choose a range of up to four months in the future and 24 months in the past.

- Click “Search” to check the eligibility status.

- The results will provide full details on the beneficiary’s eligibility, including the statuses for Part A and Part B, along with their effective and termination dates.

Method #3: Verifying Medicare Part A & Part B Eligibility via IVR

The Interactive Voice Response (IVR) system lets you verify Medicare eligibility over the phone. You can get details about the patient’s primary insurance, and primary care doctor, and check pre-authorization or claim statuses.

For Medicare Part A, call:

- 1-888-664-4112 (Toll-free)

- 1-877-660-1759 (For those with hearing impairments)

For Medicare Part B, call:

- 1-866-454-9007 (Toll-free)

- 1-877-660-1759 (For those with hearing impairments)

IVR service is available during these hours (excluding holidays):

- Monday to Friday: 7 a.m. to 7 p.m. ET

- Saturday: 6 a.m. to 3 p.m. ET

For more complex issues, such as questions about insurance plans and benefits, you can reach Customer Service Representatives (CSR) during:

- Monday to Friday: 8 a.m. to 4 p.m. ET (For Florida providers: CT)

- 8 a.m. to 4 p.m. ET (For providers in the U.S. Virgin Islands)

Method #4: Verifying Eligibility via MAC Online Provider Portal

Medicare Administrative Contractors (MACs) handle claims and eligibility verification for Medicare. They offer online portals for providers and suppliers to manage these tasks. It is crucial to periodically review a beneficiary’s eligibility to ensure accurate billing for services.

If you are not yet registered with your MAC:

- Reach out to your MAC or find their portal online to register.

Once you are registered, you can use the portal to verify a Medicare beneficiary’s eligibility by entering:

- The beneficiary’s Health Insurance Claim Number (HICN) or Medicare Beneficiary Identifier (MBI)

- The beneficiary’s first and last name

- The beneficiary’s date of birth

The portal is available anytime for self-service.

Method #5: Verifying Eligibility by Phone with MAC

MACs also offer phone-based verification. You can find the MAC phone number on their website by state.

To verify eligibility, you will need to authenticate through the phone system with:

- National Provider Identifier (NPI)

- Provider Transaction Access Number (PTAN)

- Tax Identification Number (TIN)

After you are authenticated, provide:

- The beneficiary’s HICN or MBI

- The beneficiary’s first and last name

- The beneficiary’s date of birth

This service is available 24/7.

Method #6: Using the HIPAA Eligibility Transaction System (HETS)

The HIPAA Eligibility Transaction System (HETS) allows you to verify eligibility through a secure, HIPAA-compliant transaction. You will need to submit a HETS 270 request with:

- MBI

- First and last name

- Date of birth (MM/DD/YYYY)

Best Practices for Verifying Medicare Coverage

Verifying Medicare coverage is crucial to ensure accurate billing and reimbursement. Here are some best practices for verifying Medicare coverage:

Confirm Key Medicare Benefit Details

Providers should confirm key Medicare benefit details, including the patient’s Medicare beneficiary identifier, coverage dates, and benefits. This information can be obtained through the Medicare website, phone verification, or electronic data interchange (EDI) verification.

By following these best practices, providers can ensure accurate Medicare eligibility verification, reduce the risk of denied claims, and improve cash flow.

If the patient is eligible, you will get a 271 response with details like Part A and Part B entitlements, Part D coverage, remaining hospital lifetime reserve days, and skilled nursing facility days.

Note: To use HETS, your medical billing software must be integrated with the system. This setup is particularly useful for larger healthcare facilities that want to handle everything in-house quickly and securely.

When dealing with Medicare patients, providers need to check their coverage ahead of time. Before you schedule any appointments, make sure to verify the patient’s eligibility. This will tell you what services Medicare will cover and what the patient’s out-of-pocket costs might be. Doing this early helps keep your revenue cycle on track and avoids any surprise bills down the line.